Know Your Business: a critical element of Customer Due Diligence

Know Your Business: a critical element of Customer Due Diligence

The regulated entities deal with clients of different natures – individuals or legal persons. Further, the legal person could be of a different legal structure, engaged in different activities, with various beneficial owners running the business operations, etc. These factors impact the level of risk these corporate customers pose to the business.

Here comes the need for the Know Your Business process to identify this ML/FT risk associated with business relationships established with corporate customers and suppliers.

What is Know Your Business?

Know Your Business (KYB) is a critical component of the AML program, which generally gets missed out under the cover of Know Your Customer. KYB is a specific terminology for the identification process for the business entities the regulated organizations are dealing with.

The KYB process requires the Financial Institutions and Designated Non-Financial Businesses and Professions (DNFBPs) to verify corporate customers’ and suppliers’ identity, including the nature of the business activity, business profile, persons making the business decisions in the name of such business entity, etc. It is an integral component that enables regulated organizations to determine whether the legal person with whom they are conducting business activities is genuine and not just a mere structure used as a veil to obscure the identity of launderers and other financial criminals.

Often, shell companies are used for money laundering, and they become the most commonly used vehicles for running unlawful money through the legal financial system and passing it as money obtained via legitimate activities. The KYB process lets the regulated entity know if the company is legitimate and exists in real rather than merely existing on paper. The KYB will let the regulated organization know about the company’s background and know if the goods traded are legal, transactions are made, and the source of the funds and financial status of the company.

KYB will strengthen the organization’s AML Program, ensuring that the AML regulations are followed in the true spirit, protecting their business against financial crimes, and preventing non-compliance penalties.

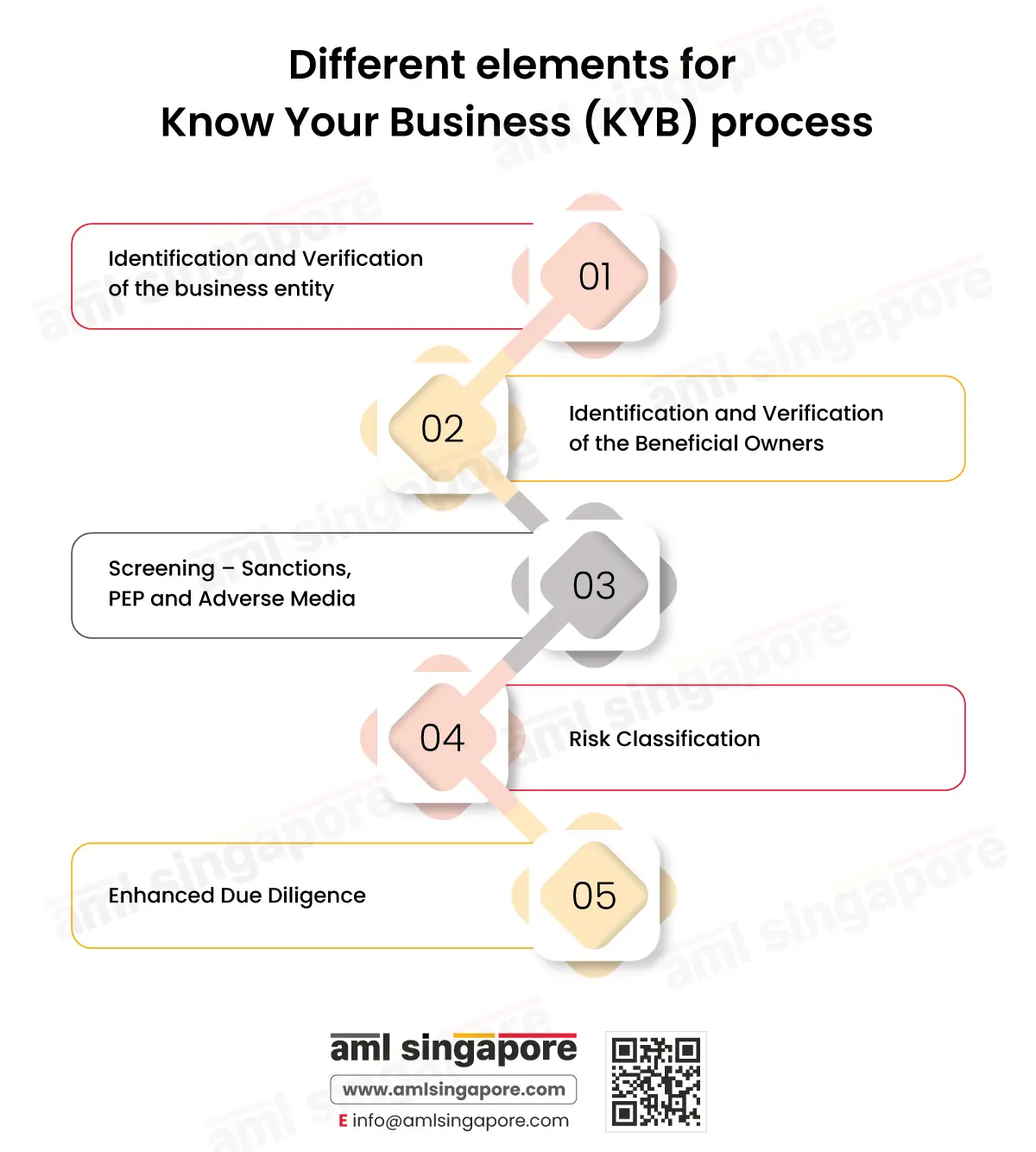

What are the elements of the KYB Process?

The KYB process establishes a business’ identity by verifying corporate documents that help establish the company’s name, place of business, legal structure, and information about the top management and stakeholders. The regulated entities can verify the business’s identity and know if it’s legitimate and is not associated with any money laundering and financing of terrorism activities by including the following measures in the KYB process.

1. Identification and Verification of the business entity:

The KYB process focuses on the due diligence aspect of AML compliance, wherein information about the business, ultimate beneficiaries, the purpose of the transaction, and allied information are collected. Further, to verify the information about the corporate entity, the corporate documents must be obtained, such as a certificate of incorporation, Unique Entity Number, Memorandum of Association, Articles of Association, etc.

2. Identification and Verification of the Beneficial Owners:

Investigating the beneficial ownership is a critical component of the KYB process that will enable the regulated entities to know who the ultimate beneficiary of the financial transactions is. Often, criminals use shell companies and set up companies in countries with lax regulatory disclosure requirements, breeding grounds for money launderers who escape the AML/CFT scrutiny and successfully launder money. The regulated organization must seek the shareholder register, senior management register, or extract from the company registry to determine the beneficial owners.

Once the beneficial ownership structure is determined, identification information such as names, nationality, shareholding in the business entity, association with Politically Exposed Persons, place of residence, contact details, etc., must be obtained for all the beneficial owners.

Further, such information must be verified using reliable, independent sources like government-issued ID cards, utility bills, third-party databases, etc.

3. Screening – Sanctions, PEP and Adverse Media:

The KYB process lets businesses know if the entity has been listed on the sanctioned list. It is essential to know about the sanctioned entities to make decisions regarding terminating or denying the business relationship with them. Not just entities, the beneficial owners and the senior management must also be screened to understand their connection with sanctions.

Further, KYB requires the regulated entities to screen the corporate customers/suppliers and their beneficial owners to determine if they have any connection with Politically Exposed Persons, as generally, association with politics increases the risk of corruption and financial crimes.

Under KYB, the regulated entities should also scan the corporates and the beneficial owners to check the presence of any adverse media. The known connection with money laundering, terrorism financing, or other financial crime increases the risk of being exploited by the corporate. Thus, the regulated entities must conduct adverse news screening for the business entity and their beneficial owners.

4. Risk Classification:

The risk classification of the business entity is highly dependent on the risk classification of the beneficial owners.

With the outcome of the identification and verification and the screening, including the results about the beneficial owners, the regulated entity must develop a risk profile of the business entity. It will enable the regulated entities to adopt a risk-based approach and decide whether Enhanced Due Diligence is required.

5. Enhanced Due Diligence:

If the business entity is classified as posing an increased risk to the regulated organization, then additional information must be obtained to determine the entity’s source of funds and wealth and rigorous checks must be performed for verification of the identities and obtaining management approval before establishing the business relationship. Moreover, the source of wealth of the beneficial owners must also be sought, if the facts warrant so, to protect the organization against money laundering attempts and safeguard the overall business interests.

In conclusion, though not popularly mentioned in the laws, KYB is vital to the anti-money laundering program. It enables in-depth insights into a corporate or legal person associating with the business. The KYB process helps to correctly assess the ML/FT risk and make an informed decision to establish a business relationship with the legal structure.

Let AML Singapore assist in stretching your AML program with a robust KYC process

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.