Best practices for identifying and implementing the right AML controls

Best practices for identifying and implementing the right AML controls

The challenges of money laundering are rising day by day. These and other financial crime threats are affecting many aspects of your business. So, dealing with them and finding the right corrective actions is vital for your business. You must have the right approach to strengthen your AML compliance in Singapore.

The first step of a robust AML framework is identifying and assessing your business risks. After this, you must identify and execute control measures to prevent these risks. This is what any business entity in Singapore does.

But it’s not as straightforward and easy a process as it seems. You require a clear, detailed strategy for planning control measures. You need to follow many steps.

So, you must adopt best practices to develop appropriate measures for your business. Without this, you will be directionless. Invest time, money, and effort to identify and execute AML/CFT control measures.

The blog here focuses on the best practices you can adopt for planning these control measures.

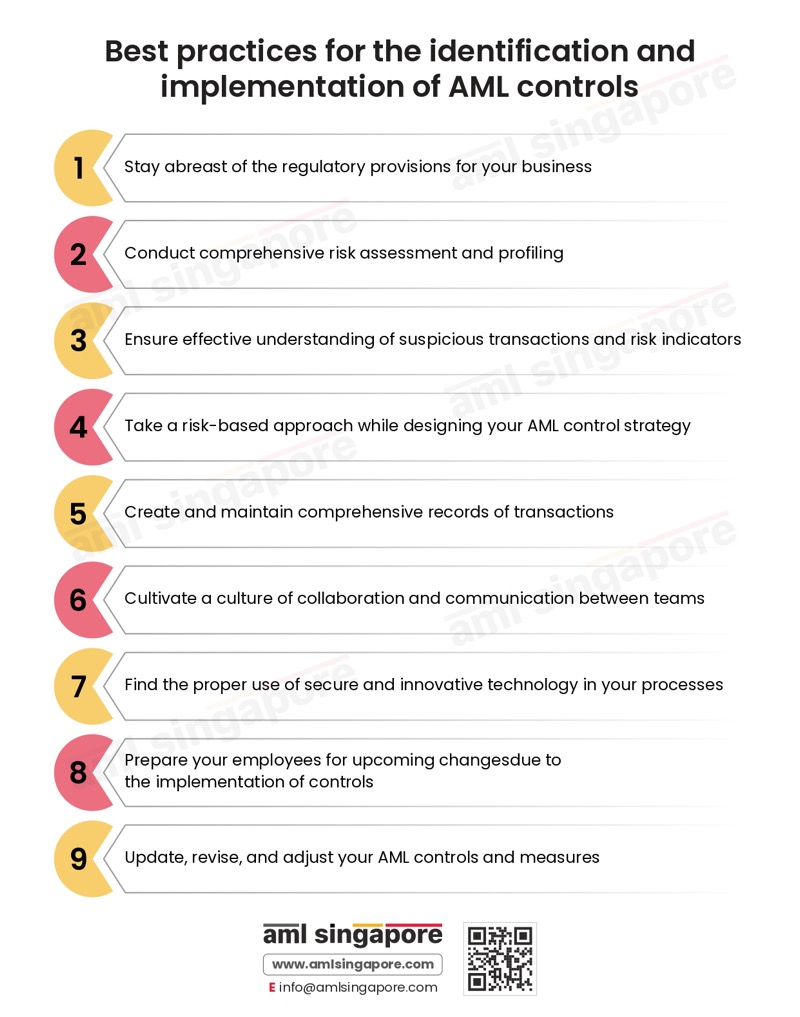

Best practices for the identification and implementation of AML controls

For framing effective AML controls to combat money laundering and terrorism financing and stay compliant with Singapore AML regulations, you must adopt the following best practices while identifying and executing AML controls:

Stay abreast of the regulatory provisions for your business

Singapore has many regulations and laws against money laundering and other financial crimes. Like other countries, Singapore extensively focuses on reducing the risks of such crimes. To this end, it keeps updating and changing its regulations in response to industry needs and rising crimes.

To develop suitable AML controls, you must stay up-to-date with these rules. You will need to refer to them while developing AML controls. You will incorporate the rules and guidelines by authorities in your internal controls. So, it is crucial to stay updated on these changes.

Failure to do so might lead to ineffective controls, resulting in non-compliance and increased exposure to financial crime.

Conduct comprehensive risk assessment and profiling

What do you need to develop measures against money laundering risks? A clear classification of risks. And how do you do that? By conducting risk identification and assessment.

That is why conducting a detailed risk detection and analysis is crucial for your business. Without the analysis, you cannot develop measures against these risks. So, identify the risks from your customers, delivery channels, products, and geographic locations. Analyze them to understand their sources and impact better.

Also, keep updating this risk assessment per the changes in regulations. Such risk assessments must include all the types of risks to your business.

If you miss such risk assessments and profiling, you will not have the basis to develop your AML controls.

Ensure effective understanding of suspicious transactions and risk indicators

The identified controls will reduce, end, or prevent money laundering. But you need to know what kinds of suspicious transactions your business can be exploited for. Understanding the red flags is crucial for putting in place proper controls.

You can detect unusual activities by implementing advanced technology systems. In these systems, you must develop rules to generate alerts for suspicious behaviour. You can also set parameters or thresholds for alert triggers. This is possible when you understand and are on top of the sector-specific financial crime typologies and trends.

Take a risk-based approach while designing your AML control strategy

Your business faces risks from different customers. Not all customers have the same risk level and type. So, you must design solutions according to each customer’s risk.

If the customer is highly risky, you must be extra cautious while dealing with or not transacting with them. If the risk is low, you can conduct transactions after confirming all details. If the risk is medium, you can conduct the basic due diligence before transacting.

You are wasting your money and time if you conduct enhanced due diligence for a low-risk customer. Similarly, a simple CDD for a high-risk customer will make you vulnerable to ML/FT risks. So, consider your risks before identifying the appropriate control measures.

Therefore, you must take a risk-based approach while strategizing these measures.

Create and maintain comprehensive records of transactions

The AML control measures are not a one-off exercise. You will have to keep implementing new initiatives as and when risks change. When new customers come on board, you might have to rethink your AML controls.

So, record keeping of suspicious transactions, risk scores, and KYC & CDD measures is essential. You can refer to these records whenever needed to develop effective AML controls. These records are also necessary during audits. You will also be required to submit some of these records to the regulatory authority.

Thus, you must have comprehensive, categorized, correct, and complete records. These records enable your compliance with AML reporting requirements.

In the absence of these records, you will fail to comply with Singapore AML laws.

Cultivate a culture of collaboration and communication between teams

The execution of any strategic initiative in an organization needs collaborative effort. Different teams must cooperate on different tasks. Be it risk management, customer handling, legal, or compliance teams, collaboration is a must.

Therefore, you must ensure collaboration and cooperation with other teams. Information sharing and smooth communication are also crucial in your AML measures.

Such communication will lead to effective measures against ML/FT risks. You can combine the intelligence of different departments to develop a cohesive approach for preventing ML/FT activities.

Besides internal communication, external collaboration is essential for an action-oriented AML plan. Such collaboration can occur with regulatory authorities, industry peers, and legal agencies. With such cooperation, you can be more aware of the types of suspicious transactions, potential customer risks, and technological innovations.

Thus, you must share information, insights, and data with internal teams and external parties. Without such collaboration, your AML/CFT measures will have gaps. It will not reflect a 360-degree assessment of the risks and preventive actions.

Find the proper use of secure and innovative technology in your processes

Technology is critical for achieving AML compliance. It is a way to reduce your threats of money laundering and terrorism financing. So, you must use the right technologies and for the proper purposes in your AML efforts. Use technological solutions for risk assessment, KYC, CDD, transaction monitoring, and recordkeeping.

The right technology can boost the quality and effectiveness of the AML controls.

Prepare your employees for upcoming changes due to the implementation of controls

While implementing internal controls, you must also pay attention to your employees. They need proper training for the changed processes and workflows. They must also accept the changes these internal control measures brought about.

You must conduct awareness programs on money laundering and other financial crimes. Participants must understand the importance of AML to prevent, mitigate, or eliminate ML/FT threats. They must be ready to accept changes in workflows and procedures due to deployed controls. Training is crucial to help them understand ML/FT trends and corrective actions. With their specialization and knowledge, you can improve your defense against money laundering threats.

Unprepared and unacceptable employees will thwart your AML control implementation.

Update, revise, and adjust your AML controls and measures

Business conditions do not always remain the same. AML regulations also keep changing. Even if your business grows or expands into new offerings or new markets. With all these changes, it is crucial to adjust your AML controls.

You must first review your existing AML policies, procedures, and controls for adjustment. If found misaligned to the goals, you must make changes. Also, if you add new business units, you must undertake risk assessments and determine controls accordingly. New risk assessments and mitigation plans are essential if you expand to new geographies.

Also, periodic reviews are necessary to look for changes in business conditions, regulations, and industry trends. You can employ external consultants and auditors for such health checks. You can update and improve your AML controls based on their insights and analysis.

If you do not update and adjust your AML controls according to market and business requirements, you will use policies not aligned with your goals. As a result, you may not generate positive results from existing AML controls as expected.

How can AML Singapore help you?

These are the best practices to adopt while determining AML controls for your business. They can help you prevent, reduce, or get rid of money laundering and terrorism financing risks.

If you are unsure about determining the AML controls yourself, AML Singapore is always at your rescue.

AML Singapore is a leading firm with expertise in AML compliance services. We can help you identify and evaluate the money laundering and terrorism financing risks your business is vulnerable to. We frame the right AML policy based on these risks to prevent ML and FT threats. We also keep you updated with your industry’s latest trends and emerging risks. Thus, you can enjoy easy and smooth compliance with AML regulations with us as your AML partner.

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.