A Guide to RORC Exemptions

A Guide to RORC Exemptions

Obligations for maintaining a Register of Registrable Controllers (RORC) are set out for Companies and Foreign Companies in the Companies Act, 1967 and Limited Liability Partnerships (LLPs) in the Limited Liability Partnerships Act, 2005. Here is a guide to RORC exemptions.

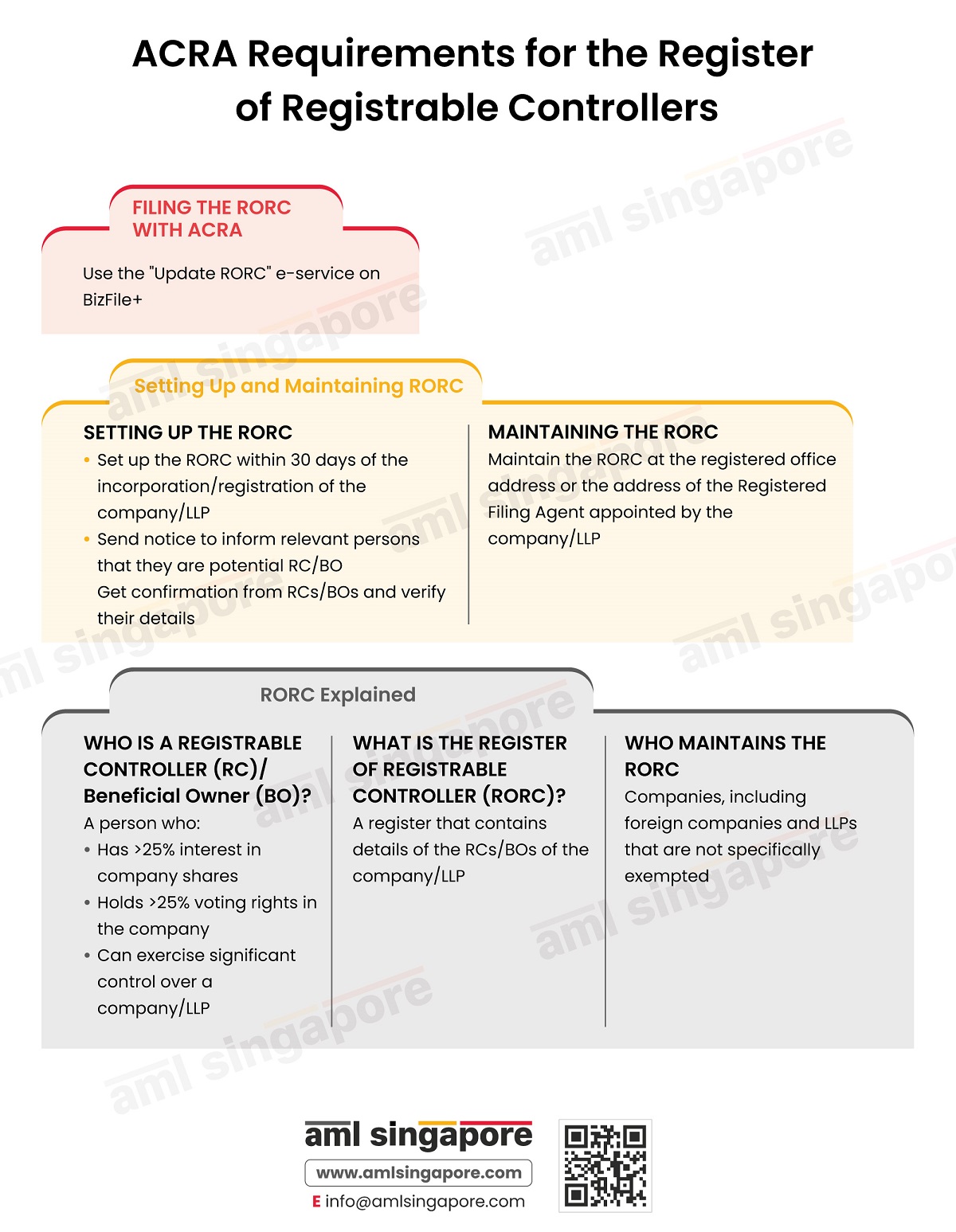

A Glance at Who is a Registrable Controller

Registrable Controllers (RCs) or Beneficial Owners (BOs) are individuals holding:

- More than 25% interest in the shares of the company

- More than 25% of member’s voting rights in the company

- Significant control or influence over the company or LLP

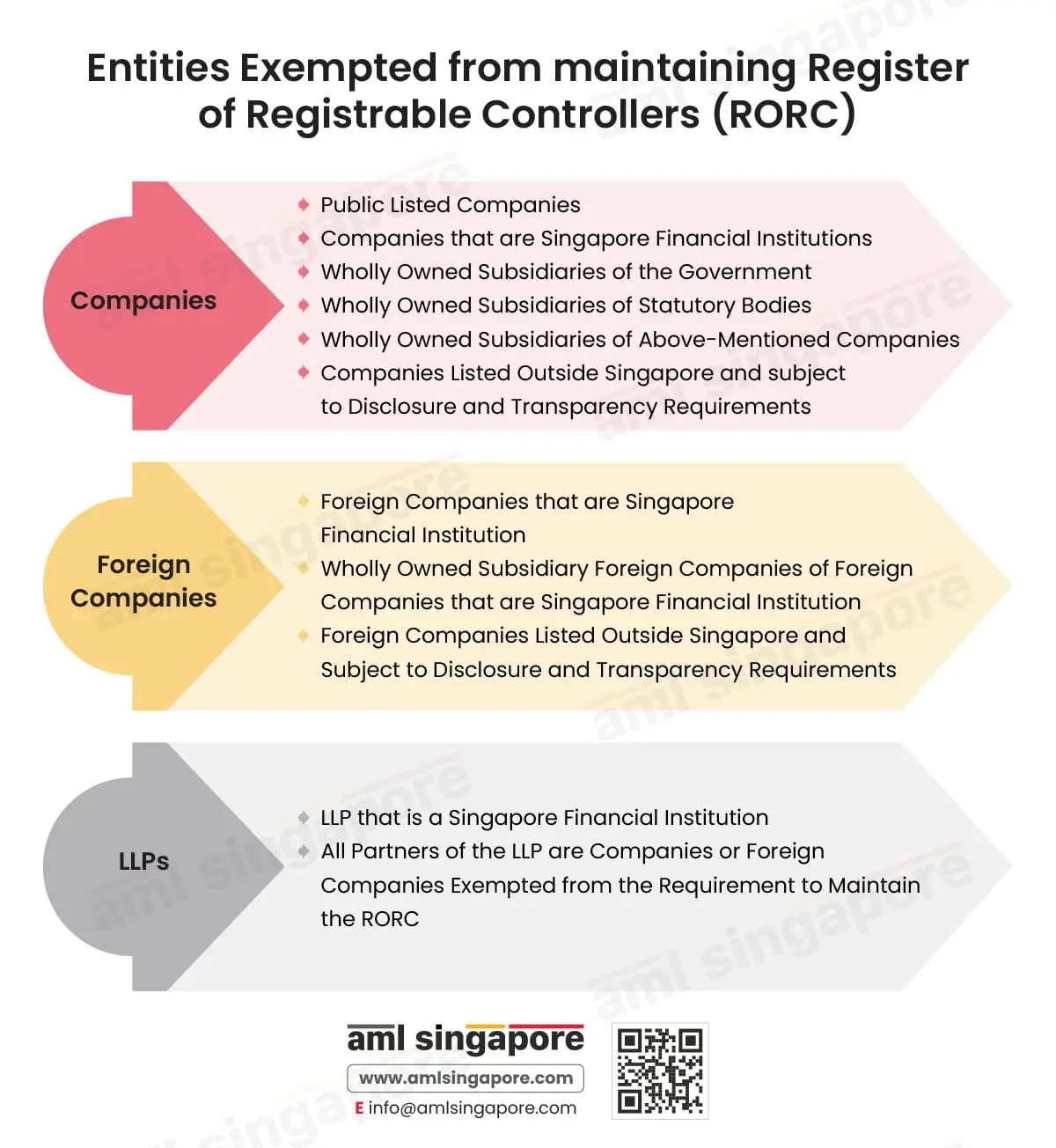

However, certain entities in Singapore are exempted from maintaining the RORC and lodging RORC information with the Accounting and Corporate Regulatory Authority (ACRA). These entities are listed below:

Exempted Companies

The Companies Act, of 1967 exempts the following companies from the RORC maintenance and filing obligations:

- Public companies listed on an approved exchange in Singapore are exempted because they are subject to disclosure obligations under the Securities and Futures Act, 2001.

- Companies that are subject to similar disclosure obligations as public companies under the Securities and Futures Act, 2001, and substantial shareholder notification also qualify for the exemption.

- Companies that are Singapore financial institutions are exempted because the Monetary Authority of Singapore.

- Wholly owned subsidiary companies of the Government.

- Wholly owned subsidiary companies of a statutory body that are established for a public purpose.

- Wholly owned subsidiary companies of the companies mentioned above

- Companies listed on a securities exchange of a country or territory outside Singapore and subjected to —

- Disclosure requirements by respective regulatory authorities

- Adequate transparency requirements for their beneficial owners Prescribed through laws, stock exchange rules, or other enforceable means.

Exempted Foreign Companies

The fifteenth schedule of the Companies Act, 1967 exempts the following foreign companies from maintaining and filing RORC information:

- Foreign companies that are Singapore financial institutions.

- Wholly owned subsidiaries of foreign companies that are financial institutions in Singapore.

- Foreign Companies listed on a securities exchange of a country or territory outside Singapore and subjected to —

- Disclosure requirements by respective regulatory authorities; and

- Adequate transparency requirements for their beneficial owners

Exempted Limited Liability Partnerships

The Limited Liability Partnerships Act, 2005 exempts the following LLPs from the maintenance and lodging requirements of the RORC:

- An LLP that is a Singapore financial institution.

- Where all partners of an LLP are companies or foreign companies exempted from the requirement to maintain the RORC.