AML Regulatory Reporting by Regulated Dealers in Singapore

AML Regulatory Reporting by Regulated Dealers in Singapore

Dealers in Precious Stones and Precious Metals and Pawn Brokers are considered Regulated Dealers and are required to comply with AML/CFT regulations of Singapore. AML Compliance obligations of the Regulated Dealers include implementing adequate internal AML/CFT policies and procedures to identify and report suspicious activities. Accordingly, these regulated dealers have been imposed with various AML/CFT reporting obligations to prevent money laundering and terrorism financing crimes and ensure 100% compliance with Singapore’s AML/CFT regulations.

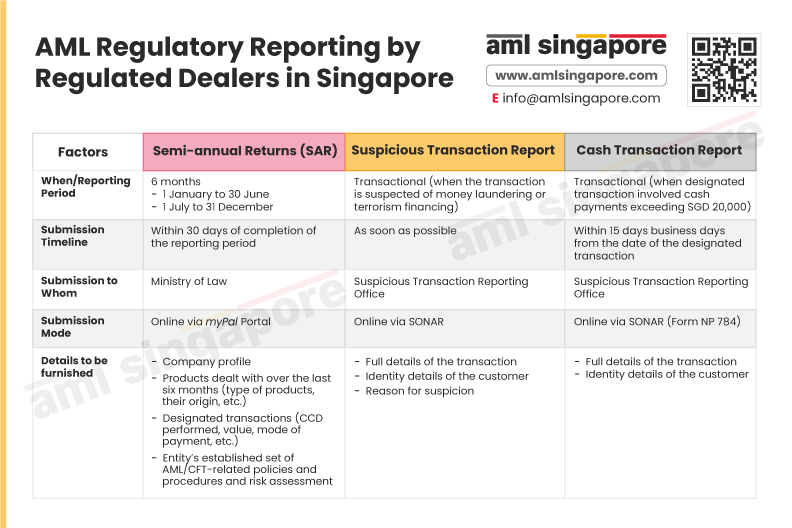

The regulatory reporting requirements that a Regulated Dealer is required to comply with under AMl/CFT regulations in Singapore are:

- Semi-Annual Return (SAR)

- Suspicious Transaction Report (STR)

- Cash Transaction Report (CTR)

An infographic here presents details – Reporting period, Timelines, Mode of reporting, details to be furnished, etc., necessary to comply with these reporting requirements in Singapore timely.

AML Singapore is an AML consultancy firm providing a comprehensive range of AML/CFT support to regulated dealers in Singapore. AML Singapore assists clients in Enterprise Wide Risk Assessment, developing AML/CFT policies, procedures and controls and meeting regulatory reporting requirements.