Corporate Service Providers Act 2024: AML/CTF Updates for CSPs in Singapore

Corporate Service Providers Act 2024: AML/CTF Updates for CSPs in Singapore

To prevent the misuse of corporate vehicles for the purpose of Money Laundering, Terrorism Financing, and Proliferation Financing (ML/TF/PF), the Accounting and Corporate Regulatory Authority (ACRA) implemented the Corporate Service Providers Act 2024, transforming the Anti-Money Laundering/ Counter-Terrorism Financing (AML/CTF) obligations for Corporate Service Providers. This blog highlights the AML/CTF updates for CSP in Singapore.

Understanding the Terms Registered Filing Agents (RFAs) and “Corporate Service Providers (CSPs)

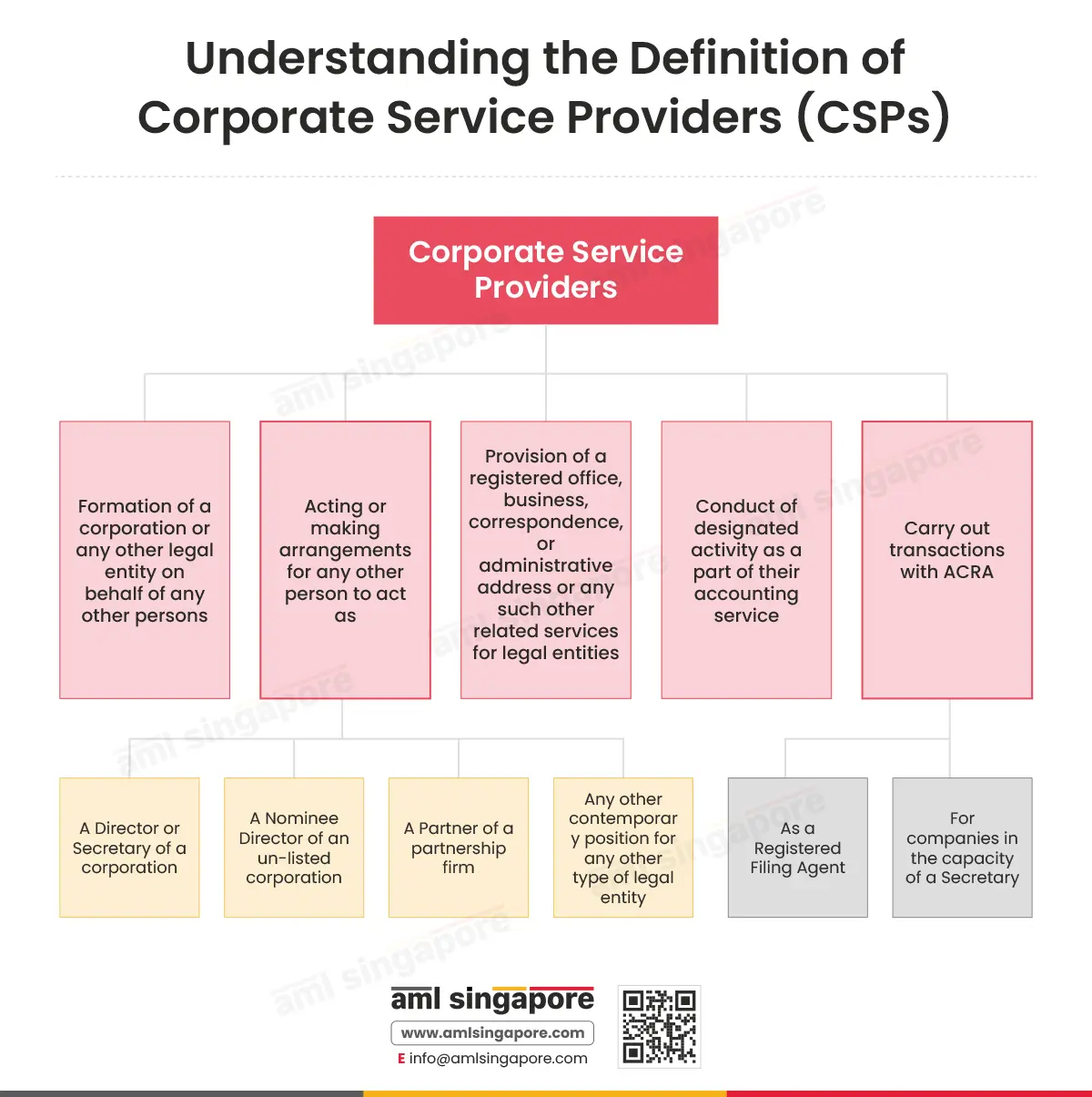

Corporate Service Providers are persons engaged in the business of:

- Formation of a corporation or any other legal entity on behalf of any other persons

- Acting or making arrangements for any other person to act as:

- A Director or Secretary of a corporation

- A Nominee Director of an un-listed corporation

- A Partner of a partnership firm

- Any other contemporary position for any other type of legal entity

- Provision of a registered office, business, correspondence, or administrative address or any such other related services for legal entities

- Conduct of designated activity as a part of their accounting service

- Carry out transactions with ACRA

- As a Registered Filing Agent

- For companies in the capacity of a Secretary

Filing Agents are a type of CSPs that are natural or legal persons who are in the business of carrying out transactions with ACRA on behalf of other persons. Under the Accounting and Corporate Regulatory Authority (ACRA) Act 2004, Filing Agents can carry out transactions with ACRA only if they are registered as RFA with ACRA.

AML/CTF Obligations Prior to Implementation of the Corporate Service Providers Act 2024

Although CSPs perform a range of services, only RFAs that prepare to carry out or carry out transactions on behalf of their customers for those services are subjected to AML/CTF requirements under the Accounting and Corporate Regulatory Authority (Filing Agents and Qualified Individuals) Regulations 2015.

The AML/CTF obligations include:

- Establishing Internal Policies, Procedures, and Controls

- Making arrangements for AML compliance management, including appointment of a Compliance Officer

- Undertaking Customer Due Diligence Measures, including proper identification and verification of the customer, their beneficial owner, and the agent’s identity.

- Ongoing Monitoring of the business relationship

- Implementing Screening during the hiring process and Training employees on AML/CTF compliance

- Implementing an Independent Audit function

- Reporting suspicious activities and transactions

- Record-Keeping

However, a large group of CSPs that cater to businesses are not RFAs and are not required to perform any AML/CTF compliance obligations. This creates a legislative gap that can be misused by illicit actors.

The CSP Act 2024 seeks to fill this gap.

Reimagine AML Compliance for Growth

Avail our premium compliance solutions and stay miles ahead of ACRA’s evolving requirements

Key Changes under the CSP Act 2024

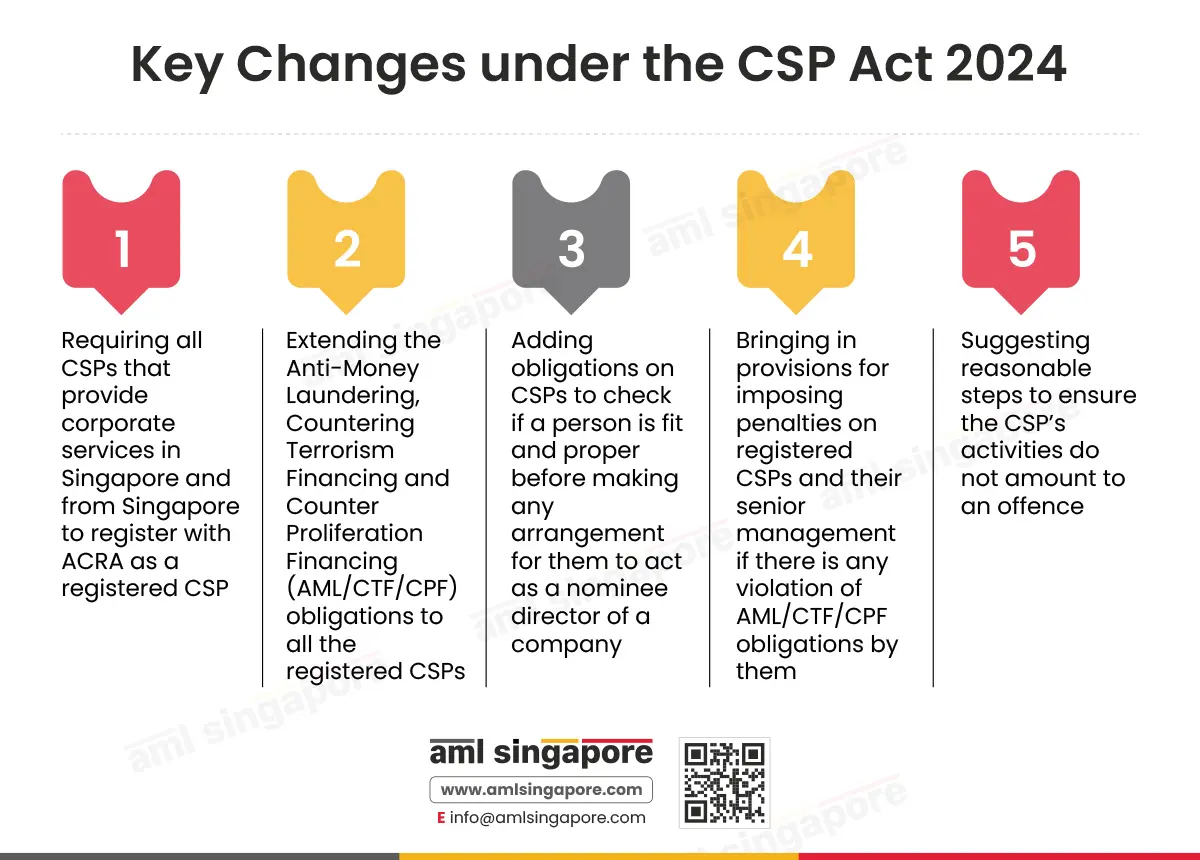

The CSP Act has brought some major changes to the AML/CTF compliance obligations for CSPs. This includes:

Requiring all CSPs that provide corporate services in Singapore and from Singapore to register with ACRA as a registered CSP.

- This means that even the CSPs which do not transact on behalf of their clients with ACRA, for instance CSPs dealing with foreign customers will also need to register themselves with ACRA.

- Interestingly, even the accounting entities that carry out designated activities are also now covered under the definition of CSP.

- It is important to note that such accounting entities are subjected to AML/CTF compliance requirements at present under the Accountants (Prevention of Money Laundering and Financing of Terrorism) Rules 2023.

Extending the Anti-Money Laundering, Countering Terrorism Financing and Counter Proliferation Financing (AML/CTF/CPF) obligations to all the registered CSPs.

- In line with the developing international obligations, all CSPs are required to not only implement measures to counter ML and TF, but also PF risks.

- All CSPs must perform Customer Due Diligence (CDD) before providing any corporate service to a customer, before lodging any transactions with ACRA, and any instance if they suspect involvement of ML/TF/PF or have doubts about the information previously submitted by the customer.

- CSPs must maintain the client documents and keep them updated as a part of their ongoing monitoring efforts.

- CDD documents and customer records should be retained for a minimum period of five years

Adding obligations on CSPs to check if a person is fit and proper before making any arrangement for them to act as a nominee director of a company.

- At present, CSPs are under no obligation to ensure that the natural persons who are arranged to act as nominee directors are fit and proper to carry out the duties of a director.

- However, this lack of scrutiny gives criminals a scope to misuse the post of nominee director in creating shell companies, especially if the nominee director is unaware of the duties and obligations of the position they hold.

- Thus, the new CSP Act requires CSPs to appoint an individual as a nominee director only if the CSP is satisfied that such a person is fit and proper by taking reasonable steps like:

- Ensuring that such a person is not disqualified from acting as a director under any law

- Verifying their compliance records and previous conduct in the companies that he/she was a director of

- Assessing if the potential nominee director has the competency, capacity, and capability to properly fulfil the obligations of a nominee director

- Considering their past experience and present commitments, including the number of existing directorships, to determine if they can take on more directorships

- Taking into consideration any other factors prescribed by regulatory authorities

- By imposing this obligation on CSPs, the new CSP Act seeks to ensure that CSPs do not arrange unqualified persons as nominee directors for their clients.

Bringing in provisions for imposing penalties on registered CSPs and their senior management if there is any violation of AML/CTF/CPF obligations by them.

- The new CSP Act seeks to enhance the effectiveness of the registration obligation by making non-registration a punishable offence.

- This means that if CSPs fail to register themselves with ACRA, they may be subjected to either a maximum penalty of SGD 50,000 or imprisonment for a maximum period of two years, or both.

- An additional penalty of SCD 2,500 per day will be charged to CSPs in case of continued offence.

- According to the CSP Act 2024, if CSPs fail to ensure the fit and proper criteria when arranging for a nominee director, they will be liable for an offence with a maximum penalty of SGD 100,000.

- Presently, the penalty for violation of AML/CTF requirements by RFAs or their Registered Qualified Individuals (RQIs) is a maximum of SGD 25,000 for every instance of violation. However, this limit is increased for CSPs under the new CSP Act to a maximum of SGD 100,000 proportionate to the risks of ML/TF/PF.

- Additionally, the senior management of the CSP, who does not ensure that the CSP should comply with AML/CTF/CPF obligations, shall also be held personally liable and be subjected to the same fine.

Suggesting reasonable steps to ensure the CSP’s activities do not amount to an offence.

- The CSP Act 2024 suggests a list of non-exhaustive steps that CSPs can reasonably take to avoid committing any offence, including:

- Checking if the CSP’s compliance set-up is sufficient to avoid the conditions making up for an offence.

- Putting in place periodic assessments by experts to assess the compliance set-up.

- Making sure that the CSP’s employees, agents, and contractors are all equipped with the right set of instructions, information, and training so they can fulfil their compliance obligations to avoid the offence of non-compliance under the act.

- Making sure that there are proper systems, processes and structures in place along with the required equipment and other resources for proper compliance to avoid any offence.

- Creating an overall compliance culture with zero tolerance for acts of non-compliance that may amount to an offence.

Regulations Changing the Game? Rewrite the Rules in Your Favor!

Avail our Ttime-tested AML compliance solutions

Updates under the Companies and LLPs (Miscellaneous Amendments) Act 2024 in Consonance with the CSP Act 2024

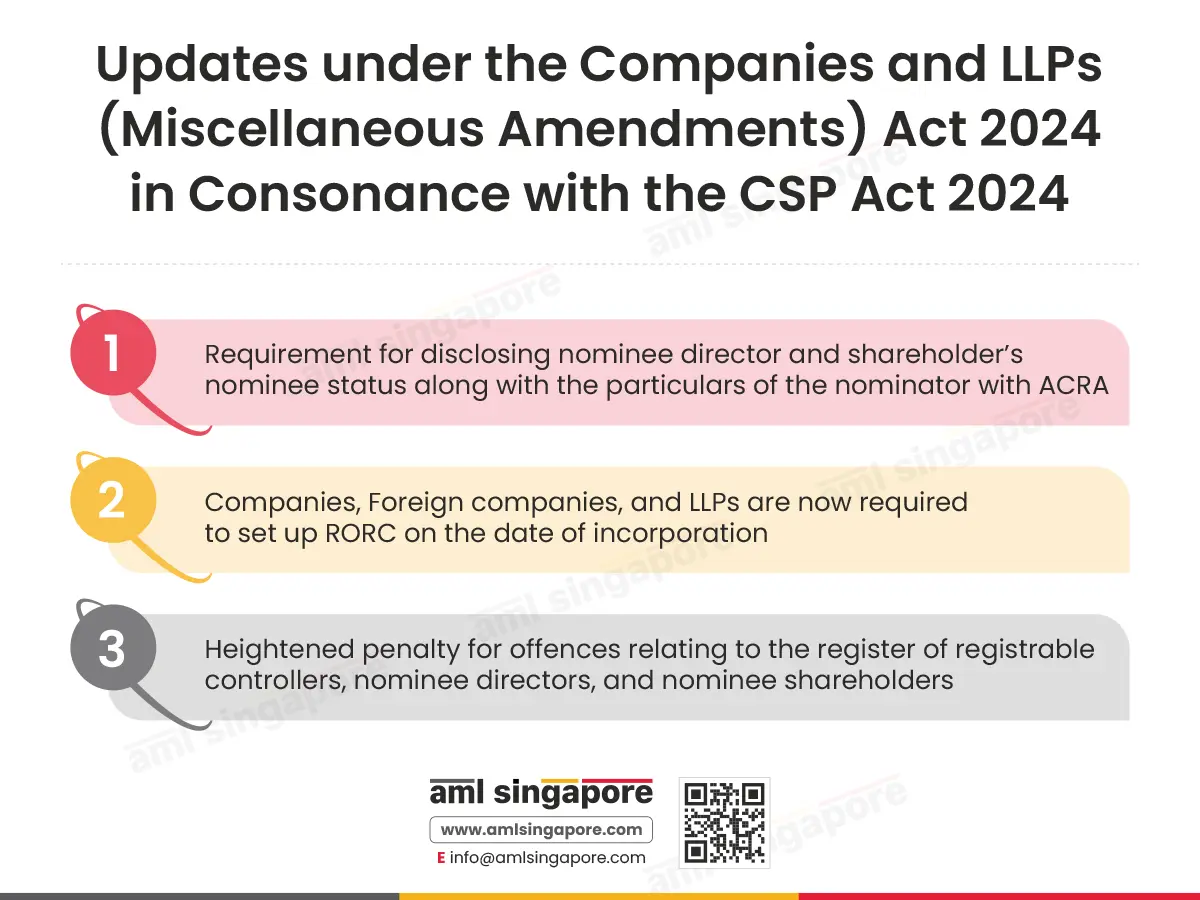

Requirement for Disclosing nominee director and shareholder’s nominee status along with the particulars of the nominator with ACRA.

- In order to ensure greater transparency within companies and foreign companies in line with the international standards on beneficial ownership, the ACRA seeks disclosure on nominee arrangements under the Companies and LLPs (Miscellaneous Amendments) (CLLP) Act 2024 so other entities that are obligated to perform AML functions can perform due diligence measures more accurately.

- Thus, moving forward, companies and foreign companies will have to share all the particulars maintained in the nominee director and shareholder register with ACRA

- All the updates in the particulars must also be communicated to ACRA

Companies, Foreign companies, and LLPs are now required to set up RORC on the date of incorporation.

- It is a step moving on from the earlier requirement of setting up RORC within 30 days of incorporation.

Heightened penalty for offences relating to register of registrable controllers, nominee directors, and nominee shareholders

- For the RORC and register of nominee directors and shareholders-related offences, the penalty has been increased to a maximum of SGD 25,000.

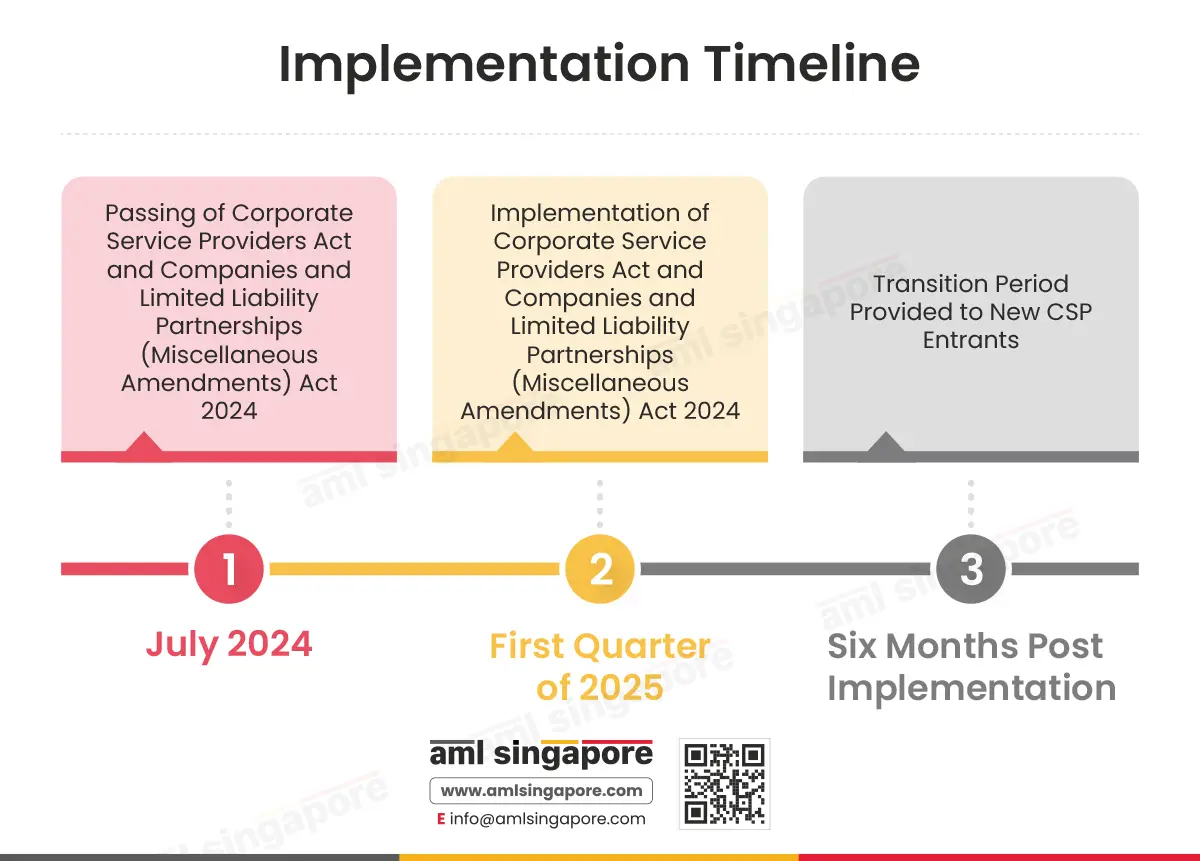

Implementation Timeline

The CSP ACT and the CLLP Act were both passed by the parliament in July 2024. However, it is said to come into effect in the first quarter of 2025. Following which, the new CSP entrants will be provided with a transition period of six months.

CSPs Stay Updated with AML Singapore

With the implementation of the CSP Act and CLLP Act in the first quarter of 2025, many more resources and guidance can be expected from regulatory authorities. CSPs are thus suggested to keep an eye on the regulatory communications and stay tuned with AML Singapore as we bring you the latest industry updates!

Frequently Asked Questions about AML/CTF Updates for CSPs in Singapore

Yes, virtual and shared office providers are potential entrants that fall within the scope of CSP who are required to register with ACRA as registered CSP.

No, only the nominee status of the nominee directors and shareholders will be made public.

No, the fit and proper requirements shall not apply to existing nominee directors.

Your AML Compliance Partner Awaits

Be the first to adapt the regulatory changes with our expert guidance

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.