Decoding the AML Risk Management Framework

Decoding the AML Risk Management Framework

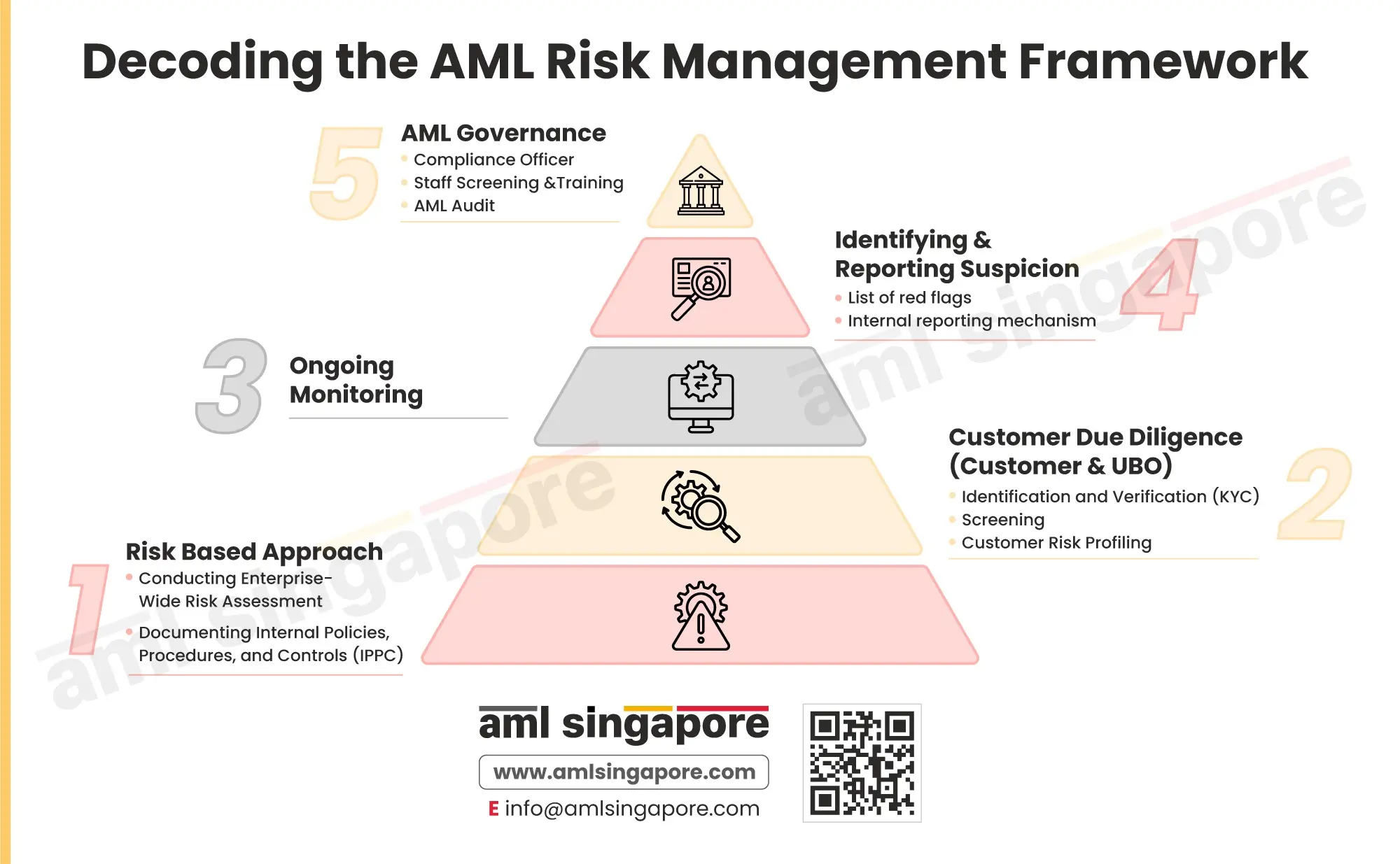

The regulated entities associated with ML/FT typologies-related goods or services and subject to AML compliance must develop and maintain a robust risk management framework. This is relevant for the Designated Non-Financial Businesses and Professions (DNFBPs) and the Financial Institutions in Singapore, required to adhere to AML regulations.

The foundation of any risk management program starts with the risk-based approach, focusing on identifying and evaluating the risk the business is exposed to. The mitigation measures, procedures and controls must be designed in sync with the outcome of the business risk assessment. The risk assessment methodology adopted, the entity’s risk profile, procedures, and controls necessary to manage the assessed risk must be well documented in the entity’s Internal AML Policies, Procedures and Controls (IPPC) documentation.

A second key element of the AML framework is Customer Due Diligence (CDD). The CDD shall encompass the measures to identify and verify the customers and the beneficial owners with whom the entity engages in business. These customer details would help develop the customer’s risk profile to make informed business decisions while keeping the risk exposure in mind. CDD shall ensure that the entity is not involved in a business relationship posing higher ML/FT risk beyond the entity’s control measures and the risk appetite.

The third in line is the ongoing monitoring of the transactions and business relationships. It serves as a nervous system of the entire AML framework, focused on continuously tracking and analysing the transaction and customer behaviour to identify suspicious activities or unusual patterns suggesting potential red flags. Ongoing monitoring ensures that any customer going beyond the initially assessed risk classification is immediately flagged for investigation for possible involvement of proceeds of crime or association with criminal activities.

The next component of the ML/FT risk management structure is the mechanism to identify the risks and report them. This is an extension of the CDD and ongoing monitoring, where the possible risk indicators are likely to be observed when the criminals try to penetrate the business at the time of onboarding or during the execution of the transactions. The framework must provide for the list of red flags and internal reporting systems, including the necessity of preliminary review and escalation to the AML Compliance Officer. Timely identifying and reporting suspicious transactions shall help the regulated entities stay compliant and safe against ML/FT vulnerabilities.

The essential function of the ML/FT risk management framework is the robust AML governance function. It is important to ensure that the developed measures are effectively implemented across the organization and that the measures stay relevant over a period of time. This requires the appointment of the AML Compliance Officer to oversee the AML program, investing in AML training for the staff to increase employee engagement – crucial for the success of AML measures and AML audit to periodically review the AML measures, systems and controls to test its efficacy and comprehensiveness.

Here is an infographic discussing the core components of an impassable financial crime risk management framework at the organizational level.

AML Singapore is a leading AML consultancy firm assisting regulated entities in developing and implementing the AML Risk Management Framework to protect the business against ML/FT threats while ensuring compliance with the mandatory AML regulatory obligations.