Explaining the Concept of Designated Transactions under the PSPM Act 2019

Explaining the Concept of Designated Transactions under the PSPM Act 2019

Individuals and entities engaged in Money Laundering(ML), Terror Financing(TF), and Proliferation Financing(PF) activities frequently use precious stones and precious metals to move their illicit money and disguise it as generated from legitimate sources. To curb ML, TF, and PF risks, the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing, and Proliferation Financing) Act, 2019 (PSPM Act 2019) introduced transaction-based requirements, where the Precious Metals and Precious Stones Dealers (PSMDs) are required to perform AML compliance functions for Designated Transactions under the PSPM Act 2019. This article explains the concept of designated transactions under the PSPM Act 2019.

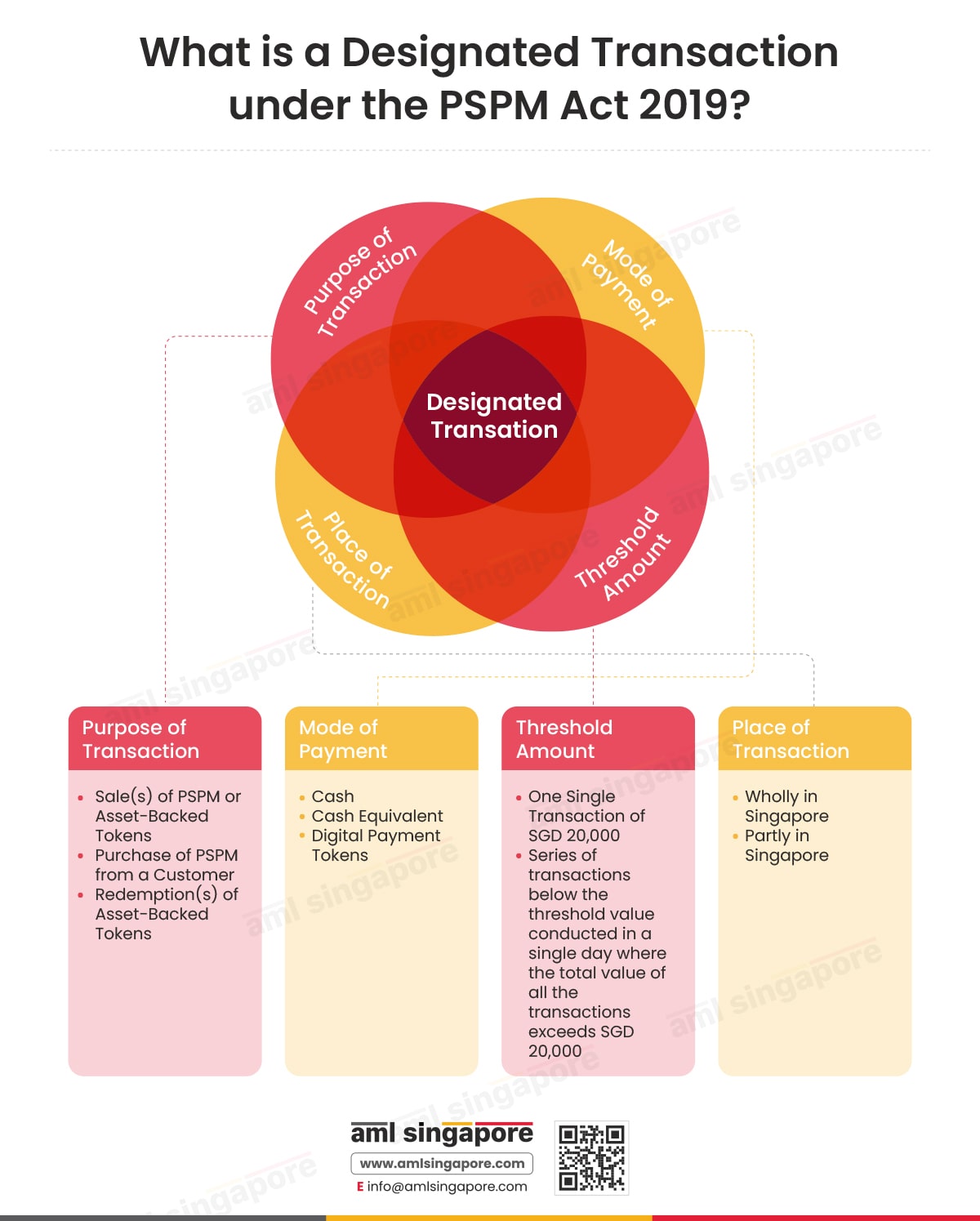

The PSPM Act 2019 provides in-depth clarity around the designated transactions, considering the following aspects, with respect to which the PSPMD must undertake necessary AML compliance:

- Purpose of the transaction

- Payment mode and threshold

- Parties to the transaction

- Location of transaction

- Count of the transactions executed

What is a Designated Transaction under the PSPM Act 2019?

A “designated transaction” under the PSPM Act 2019 is a transaction when conducted wholly or partly in Singapore and involves:

- Sale transactions of precious stones, precious metals, precious products, or asset-backed tokens by a regulated dealer to the customer against payment in cash or cash equivalent or digital payment tokens exceeding a total of SGD 20,000

- Two or more sales transactions involving precious stones, precious metals, precious products (PSPM) or asset‑backed tokens conducted by a regulated dealer in a single day to the same customer or a person acting on behalf of the same customer against cash or cash equivalent or digital payment tokens exceeding a total of SGD 20,000

- Transactions relating to the purchase of PSPM by a second-hand goods dealer from a customer (other than a regulated dealer) against a total payment of cash or cash equivalent exceeding SGD 20,000

- Transactions prescribed as designated transactions, such as the transactions prescribed in the Precious Stones and Precious Metals (Prevention of Money Laundering, Terrorism Financing, and Proliferation Financing) Regulations 2019

- Redemption of asset-backed tokens from a customer (other than a regulated dealer) against a total payment of SGD 20,000

- Two or more redemptions of asset-backed tokens in one day by a regulated dealer from the same customer or customers about whom the regulated dealer is aware are acting on behalf of the same person for cash or cash equivalent with a total value of SGD 20,000

Here, asset-backed tokens are certificates, tokens, or instruments that are backed by either one or more than one precious metal, precious stone, or precious product, where the holder of such tokens is entitled to the precious metal, precious stone, or precious product.

However, the securities and derivatives contracts under the Securities and Futures Act 2001, commodity contracts under the Commodity Trading Act 1992, digital payment tokens under the Payment Services Act 2019, and other such prescribed tokens, certificates, and similar instruments will not be covered under the definition of asset-backed tokens.

Moreover, the total value of SGD 20,000 is suggested in the PSPM Act as the “Threshold Amount”.

Here, it is essential to understand who would be treated as a “regulated dealer”. A regulated dealer is a person engaged in the business of regulated dealings or acting as an intermediary in such dealings, where the definition of regulated dealing means the following:

- Manufacture of precious metals, precious stones, or precious products

- Import or possession of precious metals, precious stones, or precious products for sale

- Sale or offer for sale of precious metals, precious stones, or precious products for sale

- Sale or redemption of asset-backed tokens

- Purchase of any precious metals, precious stones, or precious products for resale

Why Is it Important for PSMDs to Identify Designated Transactions?

Designated transactions involve cash and possess a higher degree of ML/TF/PF risk. Hence, it is essential to understand the nature of the transactions and apply appropriate risk mitigation measures.

The primary importance of identifying designated transactions is to detect and prevent the exploitation of the PSPM sector by financial criminals. Further, it is also essential to fulfil AML compliance obligations concerning designated transactions by a PSMD, including applying customer due diligence measures, reporting designated transactions to the Suspicious Transaction Reporting Office (STRO), etc.

We Simplify Designated Transaction Compliance So You Can Amplify Your Business

Our expertise and experience make AML Singapore the best choice for AML compliance for PSMDs

Legal Obligations of a PSMD Engaged in Designated Transactions

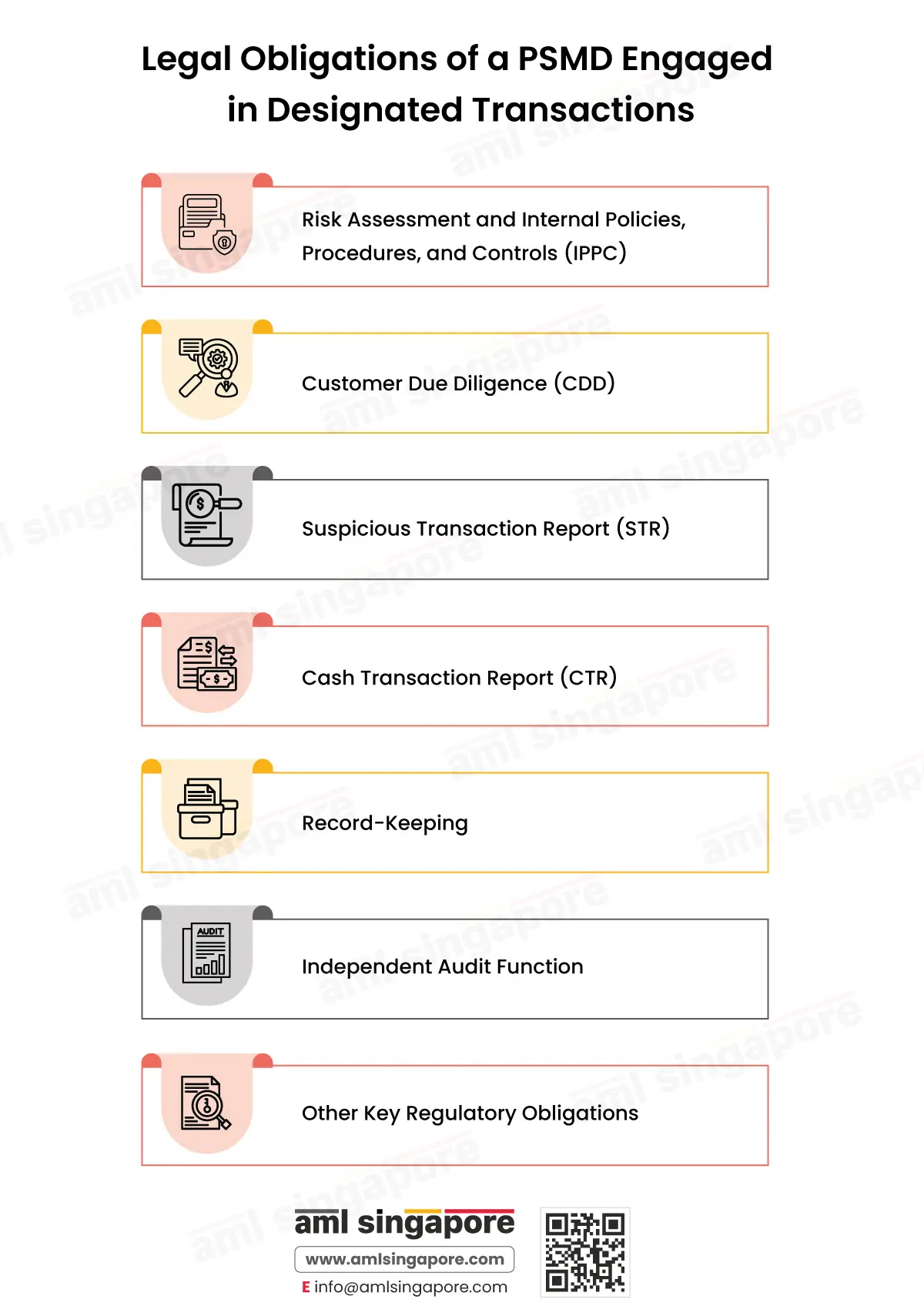

To ensure compliance with Singapore’s AML regulatory regime and check the ML/TF/PF threats, a regulated dealer must adhere to the following obligations:

Risk Assessment and Internal Policies, Procedures, and Controls (IPPC) of PSMD

A regulated dealer must conduct an Enterprise-Wide Risk Assessment to identify the exposure to ML/FT/PF arising from:

- The regulated dealer’s customers

- The geographies where the customers are from or in

- The geographies which the regulated dealer operating in

- The type of PSPM offered

- The complexities of the transactions, etc.

Based on the outcome of such Enterprise-Wide Risk Assessment and adopting a Risk-Based Approach, a regulated dealer must design, implement, and maintain its Internal policies, procedures, and controls (IPPC) to mitigate ML, TF, and PF risks, which must be approved by senior management.

The IPPC must provide detailed guidelines around performing the Customer Due Diligence measures and AML governance structure, including the appointment of a compliance officer, identification and reporting of suspicious transactions, requirement for AML training, complying with Targeted Financial Sanctions, AML Record-Keeping requirements, etc.

However, Risk Assessment and IPPC formulation are entity-based requirements, which means that these functions are to be performed by all regulated dealers even if they do not undertake any designated transaction.

Customer Due Diligence (CDD) Before Executing Designated Transactions

The regulated dealer must perform Customer Due Diligence (CDD) before entering any designated transaction. It must include measures to identify the customer and the beneficial owners, verify the identity, determine whether the customer is the owner of the funds, and screen the customer or beneficial owners to identify any connection with Sanctions Lists or Politically Exposed Persons (PEPs), etc.

Depending upon the nature of the designated transaction and the risk associated with a particular business relationship, the PSMD must apply different CDD measures. For example, for a customer identified as high-risk, enhanced customer due diligence measures must be applied, covering the inquiries around the customer’s income level, source of funds, and wealth.

When dealing with a third party, the PSMD must carry out CDD measures to identify the third party acting on behalf of the customer to execute a designated transaction. Here, the PSMD must also obtain and verify the third party’s authority or specific rights to act on behalf of the customer.

Further, the regulated dealer must terminate the transaction or reject a customer if the CDD measures cannot be applied adequately or the PSMD suspects that the designated transaction may be connected to any ML, TF, or PF activity.

Cash Transaction Report (CTR) for Each Designated Transaction

Regulated dealers carrying out business related to PSPM must file a Cash Transaction Report (CTR) with STRO when they execute a designated transaction.

CTR must be filed using Form NP 784 on the STRO Online Notices And Reporting (SONAR) platform within 15 business days after the date of executing a designated transaction.

The CTR must capture accurate and complete information on the designated transactions and the identification details of the regulated dealer, the person who executed the cash transaction, the owner of the cash/commodity/asset-backed token, and the business that owns the cash/commodity/asset-backed token.

Suspicious Transaction Report (STR)

When a regulated dealer cannot satisfactorily conclude the appropriate customer due diligence process or any red flags are observed concerning the designated transaction, the regulated dealer must file a Suspicious Transaction Report (STR) on SONAR.

The PSMD must submit the STR to the STRO as soon as the customer is identified as suspicious, involving proceeds of crime or activities related to ML, TF, or PF.

While filing STR, the regulated dealer must provide complete details of the suspected transaction, the reason for suspicion/ red flags observed, and details of the transaction.

Record-Keeping of Information for All Designated Transactions

A regulated dealer is under the obligation to maintain records about every designated transaction (irrespective of the completion status) for a minimum period of five (5) years, capturing the following details or documents:

- All customers’ and beneficial owners’ identification details collected as part of the CDD process, including supporting documents relied upon

- ID information of the person acting on behalf of the customer and proof of such authority given

- Date, addresses, and amount of transaction entered into

- Reasons recorded for inability to complete CDD or any other risk indicators observed

- Copy of all STRs filed with the STRO

- Copy of all CTRs and supporting documents relied upon for filing CTR

Independent Audit Function

The PSMD carrying out designated transactions are mandated to have their IPPC tested by an independent audit function to have an unbiased opinion regarding the accuracy and effectiveness of AML/CFT controls and measures implemented, including:

- Assessing and analysing the relevance and adequacy of IPPC

- Assessing the effectiveness of IPPC by analysing AML compliance and engagement by the employee

- Checking the quality and timeliness of the regulatory reporting

Other key regulatory obligations

In addition to the above, a regulated dealer is also required to comply with the following requirements:

- Appoint a competent Compliance Officer to manage and oversee the entity’s AML compliance, including performing a periodic review of the IPPC and its effectiveness

- Monitoring the transactions and business relationships to identify any suspicious activity or transaction

- Furnish a Semi-Annual Return (SAR) with the Ministry of Law, capturing information about the dealer’s business profile, copy of IPPC, details of designated transactions executed, etc

- Develop a robust AML training program for the staff, including senior management

Wrapping Up the Insights into the Concept of Designated Transactions Under the PSPM Act 2019

Through this article, we have discussed the meaning, importance, and obligations surrounding designated transactions for the PSPM sector in Singapore.

If you struggle to manage AML compliance, we have your back!

AML Singapore is a leading AML consultancy service provider, offering top-notch quality AML support customised to your business needs. We offer consultancy around:

- Assessing the risk and performing Enterprise-Wide Risk Assessment

- Developing Internal Policies, Procedures, and Controls (IPPC)

- Managing the KYC and Customer Due Diligence requirements

- Filing Cash Transaction Report or Suspicious Transaction Report

- Submitting Semi-Annual Return

- Imparting comprehensive AML training to the team

- Performing an independent review of the IPPC and overall AML program

Stay compliant, stay safe!

Crack the AML Compliance Code with AML Singapore

Get CDD, CTR, and STR compliance solutions all in one place.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.