Ensuring compliance with Targeted Financial Sanctions under Singapore AML regulations

Ensuring compliance with Targeted Financial Sanctions under Singapore AML regulations

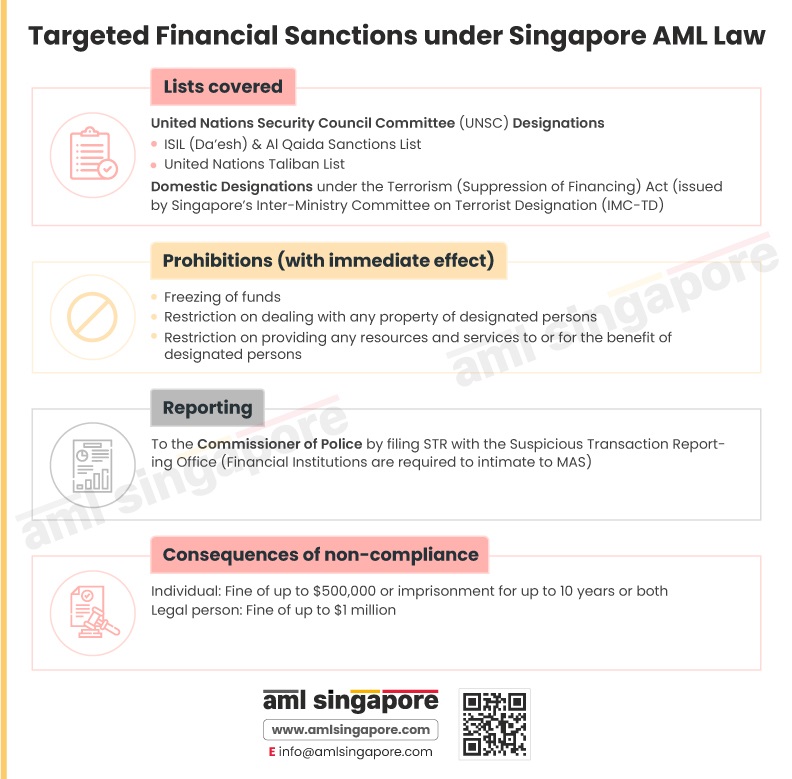

One of the essential elements of anti-financial crime compliance is – implementing the Targeted Financial Sanctions (TFS) regime. In this context, the AML regulations in Singapore mandate the regulated entities – Financial Institutions and the Designated Non-Financial Businesses and Professions (DNFBPs) to screen the customers against the Designations by the UNSC Committee and the Domestic Designations under Terrorism (Suppression of Financing) Act.

Further, the Singapore sanctions regime provides that the regulated entities must freeze the funds of any designated person encountered and shall refrain from providing any services or resources to such sanctioned person or entity.

Any matches with the sanctions lists must be reported to the Commissioner of Police by filing an STR with the Suspicious Transaction Reporting Office. While the reporting shall be done to the Monetary Authority of Singapore (MAS) when such a regulated entity is a Financial Institution.

Singapore authorities provide for a hefty fine and imprisonment in case of non-compliance with the sanctions regime.

Here is a brief visual note on Singapore’s Targeted Financial Sanctions program, the lists to be screened, the TFS measures to be applied, the reporting requirements, and the consequences of TFS violations.

AML Singapore is a leading AML consulting firm, assisting entities in Singapore in designing and maintaining robust AML/CFT compliance programs, including developing the program for complying with the Financial Sanctions regime. We also train the team to understand the entity’s AML/CFT efforts and effectively implement the Internal Policies, Procedures, and Controls across the organization.