Importance of AML Regulatory Awareness amongst the DNFBPs

Importance of AML Regulatory Awareness amongst the DNFBPs

Financial crime significantly threatens the integrity of countries and businesses. Given that Designated Non-Financial Businesses and Professions (DNFBPs) play a significant role in the financial system, they are also prone to financial crime threats, making them susceptible to being exploited by criminals for illicit activities. These financial crimes include money laundering (ML), financing of terrorism (FT), and proliferation financing (PF).

In this context, the DNFBPs established in Singapore must understand and comply with regulations concerning ML/FT and PF crimes.

Thus, DNFBPs must have adequate AML regulatory awareness to promptly identify and mitigate the risks of ML/FT and PF. Understanding ML/FT and PF risks and regulatory frameworks is essential for DNFBPs to adopt effective preventive measures to safeguard the business against such vulnerabilities and comply with regulatory frameworks.

What is ML, FT and PF?

Financial crime is an umbrella term encompassing the three vices adversely impacting the world’s financial ecosystem: money laundering, terrorism financing, and financing the proliferation of weapons of mass destruction. Although ML, FT, and PF are often used together, there are certain fundamental differences between them

Money Laundering (ML)

The crime of ML means disguising criminal proceeds and their illegal sources to make them appear as if generated from legitimate activities. In a general sense, ML is converting dirty money into clean money. It usually involves three stages—placement, layering, and integration—through which the illicit funds are placed in valid financial systems, routed through complex transactional structures, and commingled with legally obtained funds.

Financing of terrorism (FT)

FT is an activity of funding terrorist activities, which can be done irrespective of the source of the fund, i.e., the money used for terrorism financing may be from legal or illegal activities. Therefore, unlike ML, where the proceeds are from illicit activities, the source does not matter in the crime of FT. It is concerned with giving away money to terrorist organisations executing terrorist attacks or propagating the anti-social agenda.

Proliferation Financing (PF)

PF refers to the act of providing funds or any other services in relation to the manufacture, acquisition, possession, development, export, trans-shipment, transfer, stockpiling or use of nuclear, chemical or biological weapons for mass destruction and related materials for non-legitimate purposes.

These financial crimes impact the country’s economy, peace, security, and stability of the financial system.

What is ML, FT and PF Risk?

ML, FT and PF risk or the overall financial crime risk for the DNFBP is the potential exposure that the DNFBPs may face on account of it being used as a medium for facilitating money laundering, terrorism financing, or proliferation financing.

These risks may arise from the nature of the entity’s business, the geographies it is connected with, the customers it handles, or the products/services it offers.

These risks may hamper the business’s stability, harm its reputation and result in financial losses, including huge administrative penalties.

Why are DNFBPs in Singapore prone to ML/FT and PF risk?

Under Singapore’s existing AML regulatory regime, the primary businesses and professions classified as DNFBPs are:

- Dealers in Precious Stones and precious Metals (PSPM)

- Real Estate Sector Agents and Developers

- Lawyers

- Corporate Service Providers

- Public Accountants

- Casinos

- Pawnbrokers

As a global financial hub, Singapore attracts various customers and businesses, which increases the likelihood of exploiting these DNFBP segments for illicit financial activities and makes them vulnerable to ML/FT and PF risk.

For example, a criminal from a foreign country may visit Singapore and misuse a PSPM dealer to buy high-value gold or diamonds against the funds illegally generated in the home country. A registered financial agent may also be used to set up a shell company in Singapore, which shall be used as a vehicle for cross-border funds movement without engaging in real commercial operations.

How does the awareness of Singapore’s AML regulatory framework help DNFBPs?

The DNFBPs in Singapore are mandated to implement necessary risk mitigation measures as prescribed in the AML laws. The DNFBPs must understand the AML regulatory framework applicable to their operations and integrate the business activities with the relevant compliance obligations. Following is a list of a few indicators highlighting the importance of why DNFBPs in Singapore must be aware of the country’s AML regulatory framework:

Ensuring Continuous Regulatory Compliance

Knowledge and awareness of Singapore’s AML regulations help DNFBPs comply with regulatory requirements. Staying up-to-date with the regulations also helps DNFBPs learn about the new risk mitigation measures prescribed by the authorities to combat the newer ML/FT typologies.

Further, sound knowledge of the laws also helps businesses understand the consequences of non-compliance, such as penalties, fines, and other charges imposed by regulators. With a command over regulations, DNFBPs can avoid and reduce the imposition of penalties and breaches, demonstrating their commitment to responsible business practices.

For example, Regulated Dealers in Precious Stones and Precious Metals are required to file a Cash Transaction Report (CTR) for specified transactions. Thus, unless the dealer is aware of this requirement, there is a high likelihood of missing such compliance and intimating the authorities of the transactions carried in cash involving buy/sell or precious metals and stones.

Crafting Tailormade IPPC and Effectively Combating the ML/FT/PF risk

A thorough understanding of AML laws helps DNFBPs understand the compliance obligations and risk mitigation measures they must follow to protect their businesses and the economy.

AML regulatory awareness would help DNFBPs develop an AML program consisting of internal policies, procedures, and controls (IPPC), driving their ML/FT risk mitigation framework. The IPPC would be comprehensive only if the DNFBP understood the laws and regulations applicable to their business industry. This legal awareness would help the DNFBP detail the methodology for assessing the business risk, customer onboarding (Customer Due Diligence) process, AML governance structure, AML record-keeping mechanism, identification and reporting of suspicious transactions, etc.

With a robust, comprehensive, and documented AML program, the DNFBPs could educate the team and leverage the resources to identify the exposure to ML/FT and PF risks in a timely manner and promptly deploy the necessary risk mitigation actions.

Therefore, a grasp of the regulatory framework helps frame AML policies, procedures, and controls aligned with best practices and regulatory compliance. This leads to better implementation of statutory commitments within the organisation.

Building Trust and Brand Value

Knowledge of regulatory frameworks helps the DNFBPs better implement the AML compliance measures, demonstrating their commitment to combating financial crimes and building a safe and secure working environment. This builds a good business image, promoting growth significantly. Additionally, an adequate compliance culture creates an affirmative reputation among the authorities.

Further, with a comprehensive understanding of regulatory frameworks, DNFBPs promote ethical conduct and avoid penal implications and legal liabilities.

In the age of global trade, knowledge of country regulatory compliance and international requirements is important for businesses wanting to expand their business across borders. Along with an understanding of local regulations, the knowledge of Singapore’s collaboration with international organisations, such as the Financial Action Task Force (FATF), would also help DNFBPs navigate the complexities of global trade with integrity and conviction. DNFBPs with such knowledge can effectively comply with international requirements when engaging in international business and transactions. Businesses complying with AML regulations are always preferred as trusted business partners.

Thus, regulatory awareness increases trustworthiness and respect, attracts new customers and investors, and improves the business’s overall performance.

Selecting and Integrating the Business with Adequate AML Solutions and Tools

With the development in the technological sector, various AML tools and software are available that make AML compliance efficient and easy. Understanding the regulatory framework helps a business identify and deploy the best AML solutions, which helps in effectively implementing the designed AML procedures and controls. These tools with advanced features help businesses automate manual and repetitive processes, such as name screening and ongoing monitoring, and optimising the use of resources. Furthermore, DNFBPs with knowledge of regulations better allocate business resources while ensuring AML compliance.

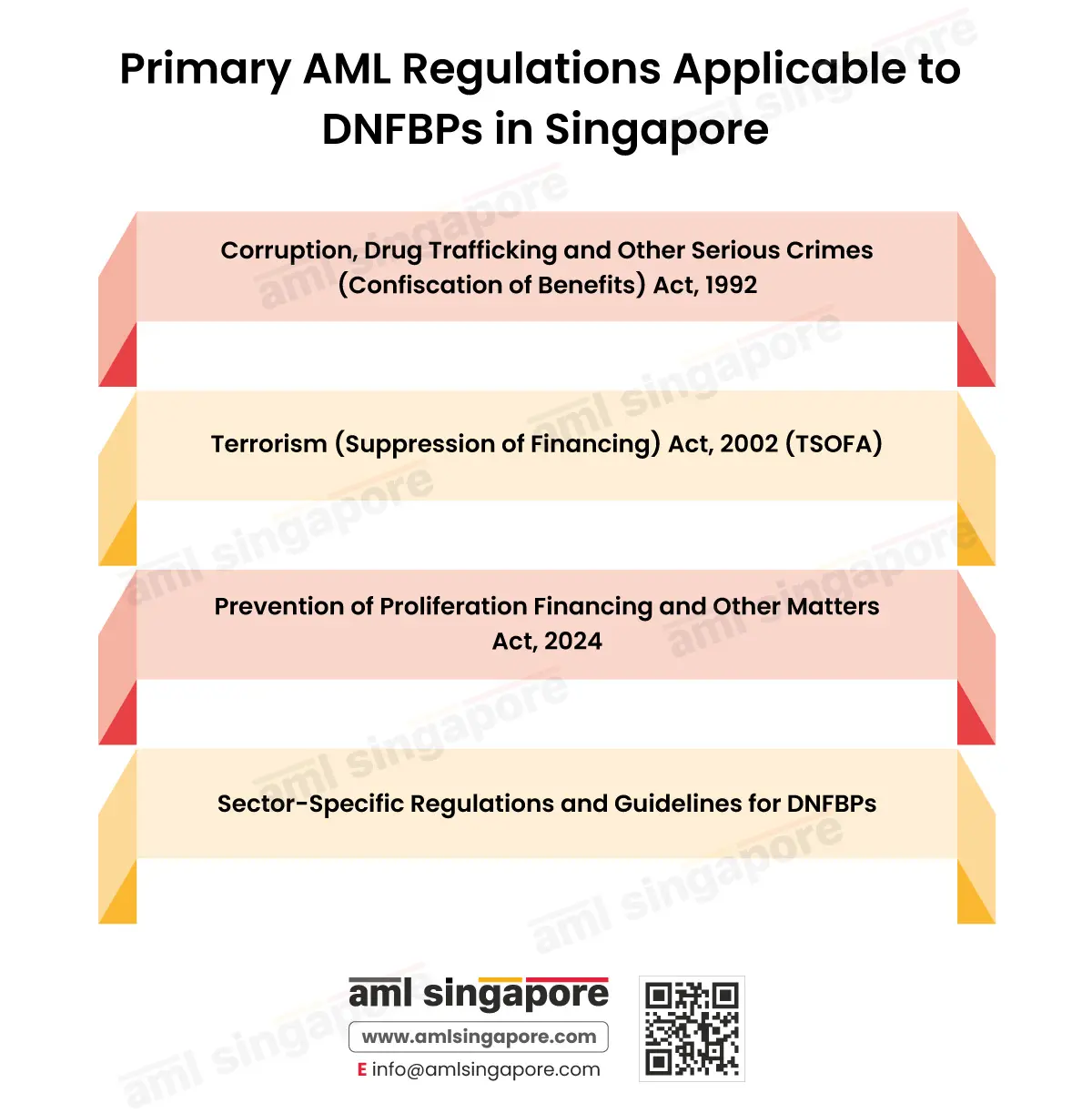

Primary AML Regulations applicable to DNFBPs in Singapore

In Singapore, the government has enacted various regulations to prevent ML/FT and PF. Here is the list of primary regulations that apply collectively to all DNFBPs in Singapore:

Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act, 1992

The Corruption, Drug Trafficking and Other Serious Crimes Act (Confiscation of Benefits), 1992 (‘CDSA’) is the primary regulation imposing a statutory obligation on reporting entities, including DNFBPs, to detect and report suspicious transactions to the authorities. The CDSA was enacted to provide a regulatory framework for combating corruption, drug trafficking, and other serious crimes, including financial crimes like money laundering.

Terrorism (Suppression of Financing) Act, 2002 (TSOFA)

The Terrorism (Suppression of Financing) Act, 2002 is Singapore’s primary legislation focused on suppressing terrorism financing. It was enacted to give effect to the International Convention for the Suppression of the Financing of Terrorism, a United Nations (UN) treaty, and to restrict terrorism financing more efficiently.

Prevention of Proliferation Financing and Other Matters Act 2024

The Singapore Government recently passed the bill and introduced the Prevention of Proliferation Financing and Other Matters Act 2024. The PPFOMA amends provisions laid down in CDSA and various supporting acts governing DNFBPs to prevent the financing of the proliferation of weapons of mass destruction. The PPFOMA aims to enhance and strengthen the existing AML/CFT framework by including the PF as a criminal activity and extending the applicability to countermeasures to this financial crime.

Other Sector-specific Regulations and Guidelines for DNFBPs

In line with the primary statutes mentioned above, various AML supervisory authorities in Singapore have issued detailed regulations and guidelines to help the relevant DNFBPs navigate compliance effectively, seamlessly protecting the segment against the financial crime risk. Some of these regulations and guidelines which the DNFBPs must be aware of and abide by are:

- Accountants (Prevention of ML and FT) Rules 2023

- ACRA (Filing Agents and Qualified Individuals) Regulations 2015

- Precious Stones and Precious Metals (Prevention of Money Laundering and Financing of Terrorism) Act, 2019

- Precious Stones and Precious Metals (Prevention of Money Laundering and Financing of Terrorism) Regulations, 2019

- Estate Agents (Prevention of Money Laundering and Financing of Terrorism) Regulations, 2021

- Legal Profession (Prevention of Money Laundering and Financing of Terrorism) Rules, 2015

- Casino Control (Prevention of Money Laundering and Financing of Terrorism) Regulations, 2009

Conclusion

FAQs on the Importance of AML Regulatory Awareness amongst the DNFBPs

DNFBP stands for Designated Non-Financial Business and Profession, encompassing real estate agents, lawyers, dealers in precious stones and precious metals, registered filing agents, pawn brokers, accountants, and casinos.

The Corruption, Drug Trafficking and Other Serious Crimes Act (Confiscation of Benefits), 1992 (‘CDSA’), and Terrorism (Suppression of Financing) Act, 2002 (TSOFA) are the primary laws for AML compliance for DNFBPs.

AML regulations for DNFBPs are essential as they safeguard DNFBPs from ML/FT and PF risks and provide a systematic methodology to combat the threats of illicit financial activities.

Although the DNFBPs are part of the non-financial sector, they engage in activities that could be exploited for ML/FT or PF.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.