Mastering PEP Identification and Onboarding for AML Compliance

Mastering PEP Identification and Onboarding for AML Compliance

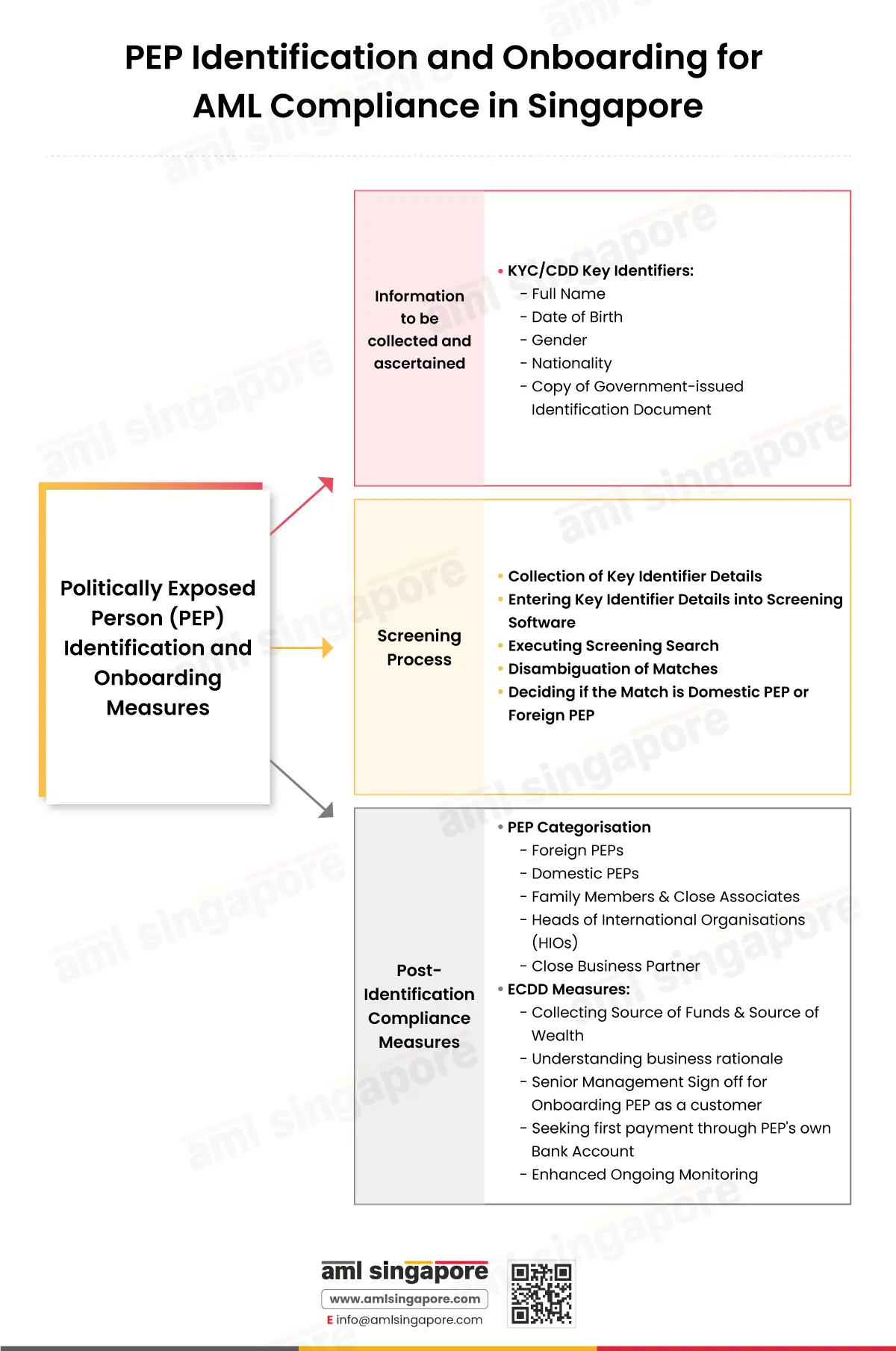

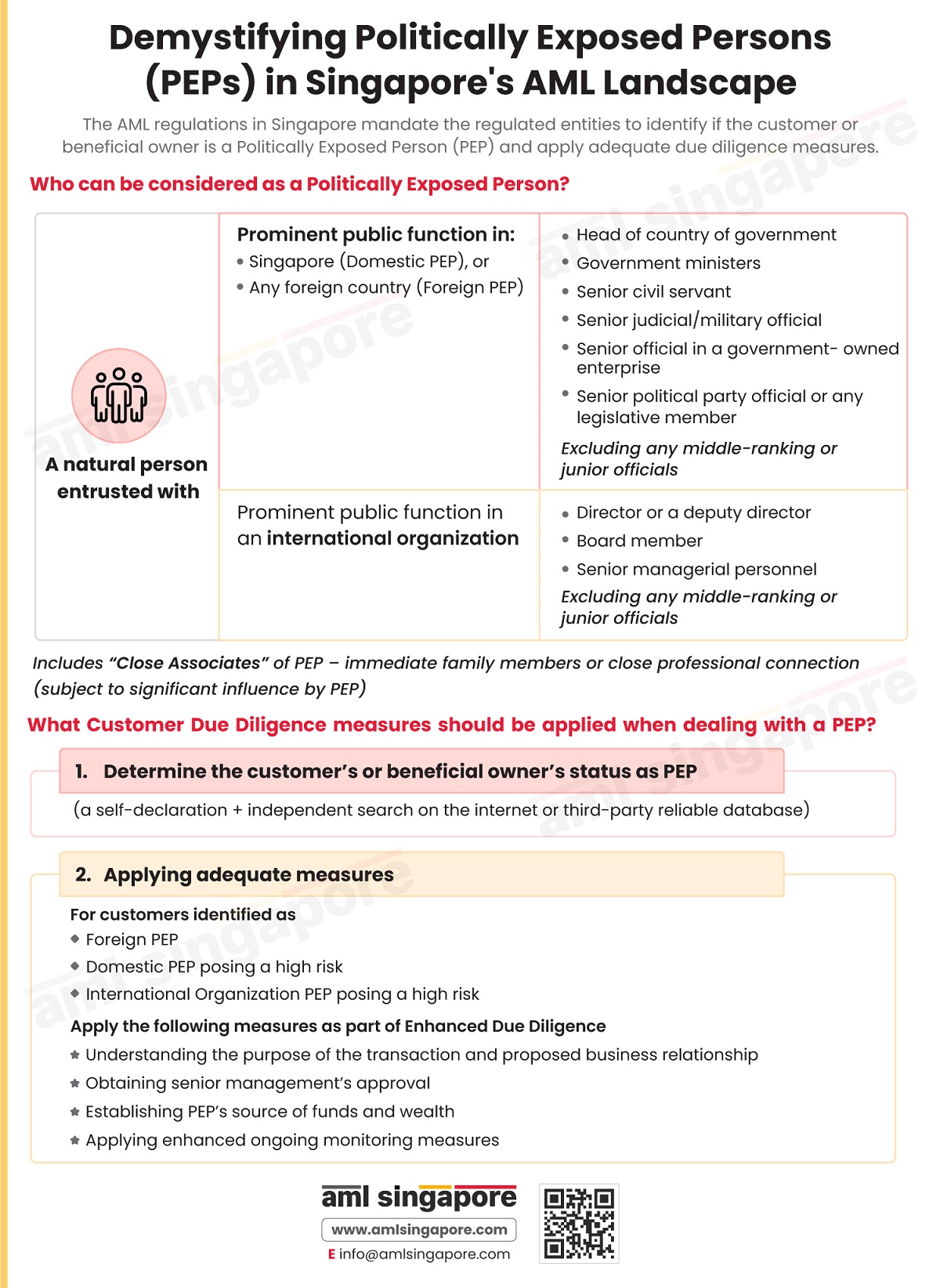

Regulated Entities in Singapore need to devise a methodology as part of their Customer Due Diligence (CDD) process that clearly states how they shall onboard Politically Exposed Persons (PEPs) as individual customers or as Ultimate Beneficial Owners (UBOs) of legal entities or legal arrangements.

Mastering PEP Identification and Onboarding for AML Compliance will help regulated entities counter Money Laundering (ML), Financing of Terrorism (CFT), and Proliferation Financing (PF). Here is the infographic providing insights into the PEP identification and onboarding process.

Collection of KYC/CDD Key Identifiers

Regulated Entities must collect key customer information, Customer Due Diligence / Know Your Customer (KYC) Details, or Key Identifier Details such as:

- Full Name

- Date of Birth

- Gender

- Nationality

- Copy of Government issued Identification Document

The collection of these details and supporting documents enables regulated entities to carry out further steps of the screening process.

Screening Process

Carrying out the PEP screening process entails the following steps:

- Collection of Key Identifier Details

- Entering Key Identifier Details into Screening Software

- Executing Screening Search

- Disambiguation of Matches

- Deciding if the Match is Domestic PEP or Foreign PEP

Once it is determined whether customer or the UBO screened is PEP, following steps need to be taken to ensure adequate compliance with AML/CFT and CPF laws in Singapore.

Post-Identification Compliance Measures

PEP Categorisation: The individual customer or UBO identified as PEP needs to be classified either as

- Foreign PEPs

- Domestic PEPs

- Family Members & Close Associates

- Heads of International Organisations (HIOs)

- Close Business Partner

- Current or past PEP

This PEP categorisation helps Regulated Entities to classify whether the PEP customer poses high, medium, or low Money Laundering (ML), Financing of Terrorism (FT), or Proliferation Financing (PF) risks, among other risks such as corruption, bribery, and financial crime risks to the Regulated Entity. Accordingly, the Regulated Entity can determine whether to undertake Enhanced Customer Due Diligence (ECDD) measures.

However, a Regulated Entity must proceed with Standard Due Diligence if the customer, despite being PEP, poses low or medium ML/FT and PF risk, which does not necessitate undertaking ECDD measures. Such a decision forms a part of Risk Based Approach (RBA) where Regulated Entities must take proportionate or commensurate measures according to ML/FT and PF risks posed by a customer to the business.

- If the PEP is classified as a high-risk customer, Enhanced Customer Due Diligence (ECDD)measures must be taken by collecting the Source of Funds and Source of Wealth (SoF & SoW) to ensure that the funds utilised by the PEP for the transaction in question are legitimately earned and are not proceeds of crime plus understanding the business rationale.

- After collecting SoF and SoW, the compliance team of a Regulated Entity can decide whether or not to onboard the PEP as a customer, basis the authenticity of documents, its contents and rationale of the proposed transaction. Such a decision must be signed off, which means approved by the Senior Management of the Regulated Entity.

- Seeking first payment through PEP’s own Bank Account.

- Lastly, if an onboarding decision is made, the Regulated Entity must deploy Enhanced Ongoing Monitoring measures to closely monitor the business relationship with a PEP.

Conclusion

A Regulated Entity must ensure that they take adequate measures to identify if a natural person customer or UBO of a legal entity or legal arrangement customer is PEP. Once PEP status is confirmed Regulated Entities should take RBA and proceed with necessary steps.

Related Posts

Confused About PEP Onboarding?

PEP Identification and Onboarding made easy with AML Singapore