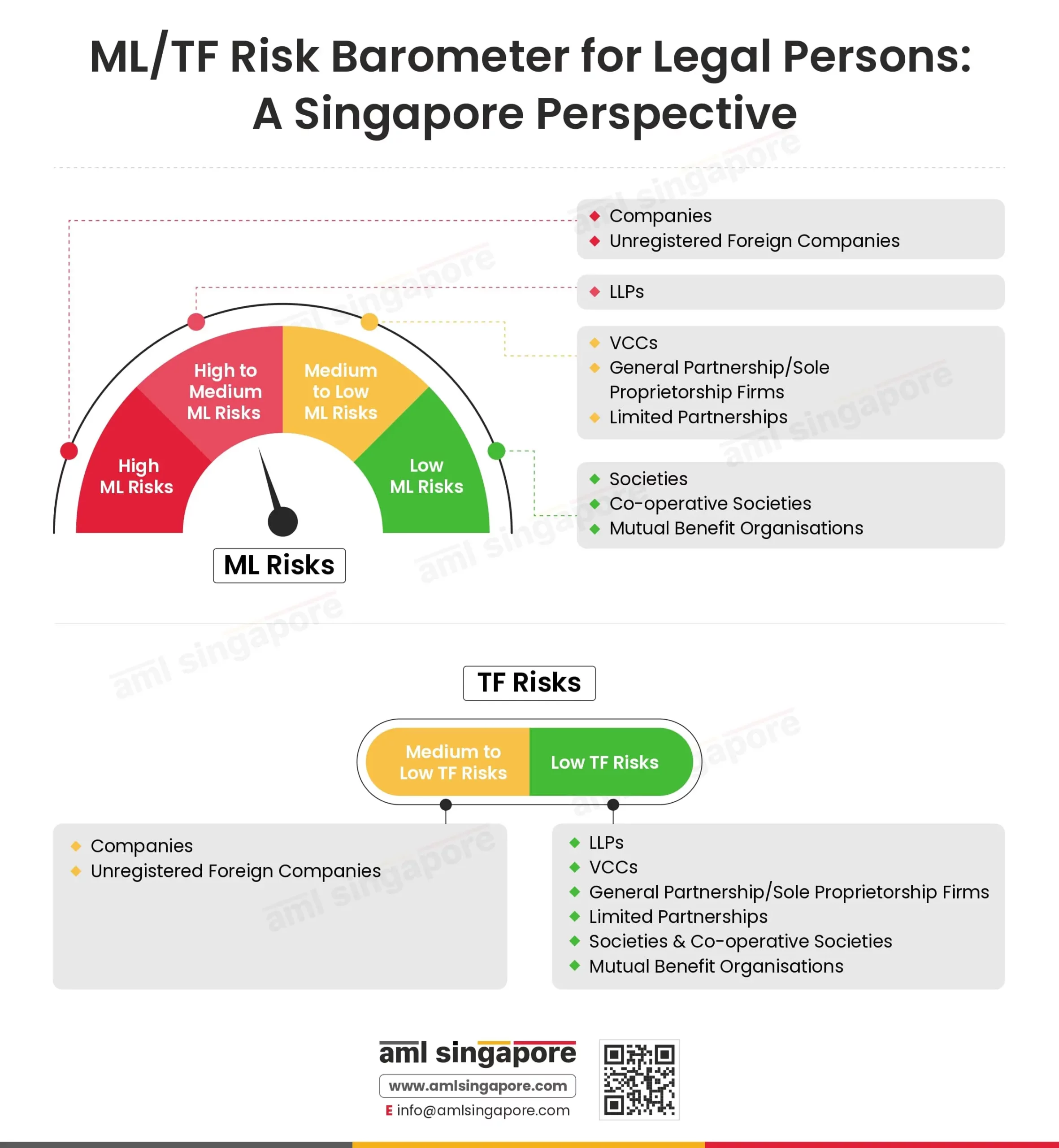

ML/TF Risk Barometer for Legal Persons: A Singapore Perspective

While identifying inherent elements of potential risk, regulated entities should take into consideration the degree of risk associated with Money Laundering and Terrorism Financing (ML/TF) due to their legal structure. The ML/TF Risk Barometer for Legal Persons illustrates how the magnitude of ML/TF differs for different legal entities as stipulated in their Sectoral Risk Assessment by the Accounting and Corporate Regulated Authority (ACRA).

Legal Persons with High ML Risks and Medium to Low TF Risks

Companies

Companies incorporated under the Companies Act 1967 are at a high risk of money laundering activities involving fraud, corruption, trade-based money laundering, etc.

Certain features of companies can be misused by criminals for obscuring ownership and creating shell companies for money laundering, which can also expose the companies to Terrorism Financing risks.

Unregistered Foreign Companies

Foreign companies that engage in limited designated activities in Singapore, including the performance of legal works, the execution of a sales transaction through independent agents, property holding, fund investing, or even the possession of a bank account, are not obliged to register with ACRA or other regulatory bodies, and as such, are termed Unregistered Foreign Companies.

The lack of regulation for Unregistered Foreign Companies in Singapore has resulted in gaps within the sector that are not easily reconciled by the existence of a structured oversight mechanism, such as a beneficial ownership structure.

Most of these Unregistered Foreign Companies do not have persons located within the jurisdiction of Singapore, which makes it impossible for the regulatory bodies to obtain assistance from these entities during the investigations. This lack of responsibility contributes to the overall weakness of these entities.

Legal Persons with Medium to High ML Risks and Low TF Risks

Limited Liability Partnerships (LLPs)

LLPs registered under the Limited Liability Partnerships Act 2005 are at medium to high risk from ML activities and comparatively lower TF Risks. LLP structure allows individuals to appoint managers to handle the affairs of the LLP. This can be potentially misused by illicit actors to disguise their beneficial ownership in the LLP.

Legal Persons with Medium to Low ML Risks and Low TF Risks

Variable Capital Companies (VCCs)

VCCs came into existence in 2020 under the Variable Capital Companies Act 2018, specifically for the purpose of fund management. Certain illegitimate actors, however, can exploit the high-confidentiality feature of VCCs for money laundering and terrorism financing.

General Partnership/Sole Proprietorship Firms

General Partnership/Sole Proprietorship Firms registered under the Business Names Registration Act 2014 can be misused by criminals as sometimes natives give their Singpass credentials to unknown parties for the creation of a firm, but these credentials are later misused by third parties for other illegal purposes.

However, ACRA’s effective controls on the firms reduce their ML/TF risks.

Limited Partnerships (LPs)

Limited Partnerships established under the Limited Partnerships Act 2008 are vulnerable to ML/TF risks as it has been observed statistically that partners in LPs are usually foreign legal entities. Such possibility for the creation of complex structures with participation from cross-border entities can be misused by illicit actors.

Legal Persons with Low ML/TF Risks

Societies

Societies, clubs, and associations formed under the Societies Act 1966 are at low ML/TF risks as their constitution and other documents, such as their annual returns, are available for the general public. In fact, members of societies can inspect the financial records of the society. Such transparency of activities makes societies less prone to ML/TF risks.

Co-operative Societies

The Co-operative Societies Act 1979 governs the formation of co-operative societies. The total number of cooperative societies in Singapore is low; hence, they are at a low risk of being involved in ML/TF activities.

Mutual Benefit Organisations (MBOs)

The Mutual Benefit Organisations Act 1960 governs the Acts of Mutual Benefit Organisations. As the total number of MBOs in Singapore is less than 100 and the last MBO was established over a decade ago, MBOs are not so susceptible to ML/TF activities.

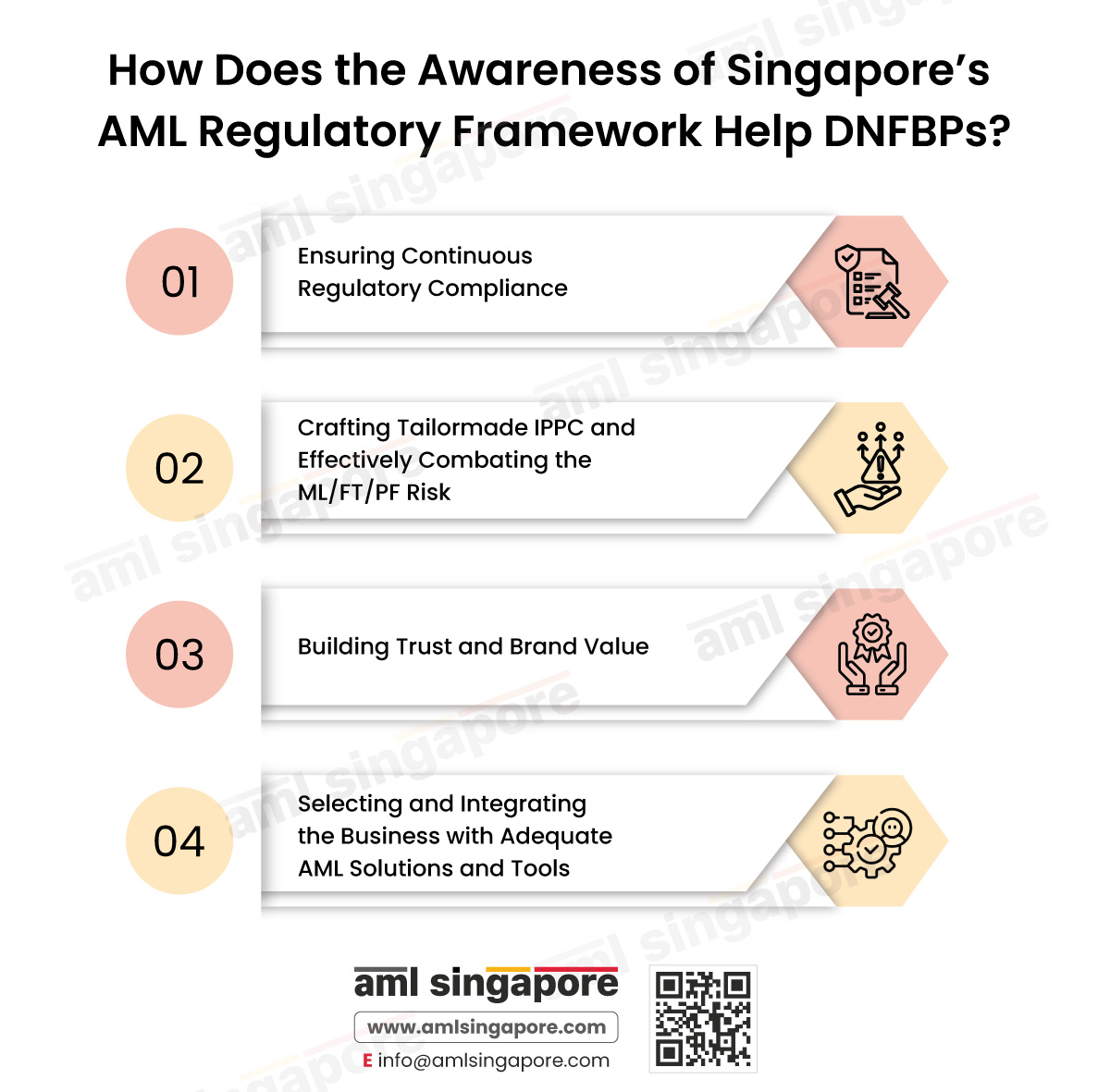

Strategies for Preventing the ML/TF Risks to Legal Persons

To prevent the ML/TF risks arising out of the legal structure of the organisation, regulated entities should strive to effectively follow the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) measures outlined by their respective regulatory authorities.

Risk Isn’t Always Loud, Are You Listening?

Limit your ML/TF risk exposure with AML Singapore’s expert solutions