Navigating the Sanctions and PEP Screening under Singapore AML Laws

Navigating the Sanctions and PEP Screening under Singapore AML Laws

The Financial Institutions and the Designated Non-Financial Businesses and Professions (DNFBPs) must apply appropriate due diligence measures when establishing a business relationship. This includes identifying the person as a Politically Exposed Person (PEP) or a close associate or relative to it and checking whether the person is designated under any sanctions list. This identification assists the regulated entities in adopting the risk-based approach.

Understanding the Sanctions Screening in Singapore

Sanction lists help deter financial crime by boycotting a country, a group of countries, business organizations, or individuals for the illegal acts they have committed or are suspected of committing. The sanctions list will help businesses lower the risk of creating or maintaining a business relationship with the sanctioned entities.

The regulated entities in Singapore are required to follow the below-mentioned sanctions lists:

A. United Nations Security Council Committee (UNSC) Designations

- ISIL (Da’esh) & Al Qaida Sanctions List

- United Nations Taliban List

B. Domestic Designations under the Terrorism (Suppression of Financing) Act [issued by Singapore’s Inter-Ministry Committee on Terrorist Designation (IMC-TD)]

Sanctions screening assists the regulated entities in identifying if any customers or prospects are designated under any sanctions lists or relate to the sanctioned persons.

The Singapore AML/CFT regulations mandate the entities to apply the freezing measures and immediately terminate the business relationship, as there is a restriction on providing financial aid or services to the sanctioned person. Further, the entities are also required to report the sanctioned matches with the Commissioner of Police and the Monetary Authority of Singapore (MAS), as the case may be.

Understanding the PEP (Politically Exposed Person) Screening in Singapore

PEP is defined as a person entrusted with a prominent public responsibility in a domestic or foreign country, for example, senior politicians or heads of country. They are people who can influence government contracts or have the power to control them owing to their public position and the powers they exercise because of their prominent public role, paving the way for corruption and other malpractices.

To detect the potential financial crime risk posed by the PEPs, the Singapore AML regulations mandate the regulated entities to screen the customers and prospects to determine their status as PEPs or closely connect with the PEP.

Please note that there is no restriction under the law on dealing with PEPs, but the obligation is to adequately manage the financial crime risk (owing to the possibility of indulging in corruption and bribery) posed by the PEPs. Generally, PEP should be considered as PEP, and Enhanced Customer Due Diligence measures must be adopted, including identifying the customer’s source of funds and wealth.

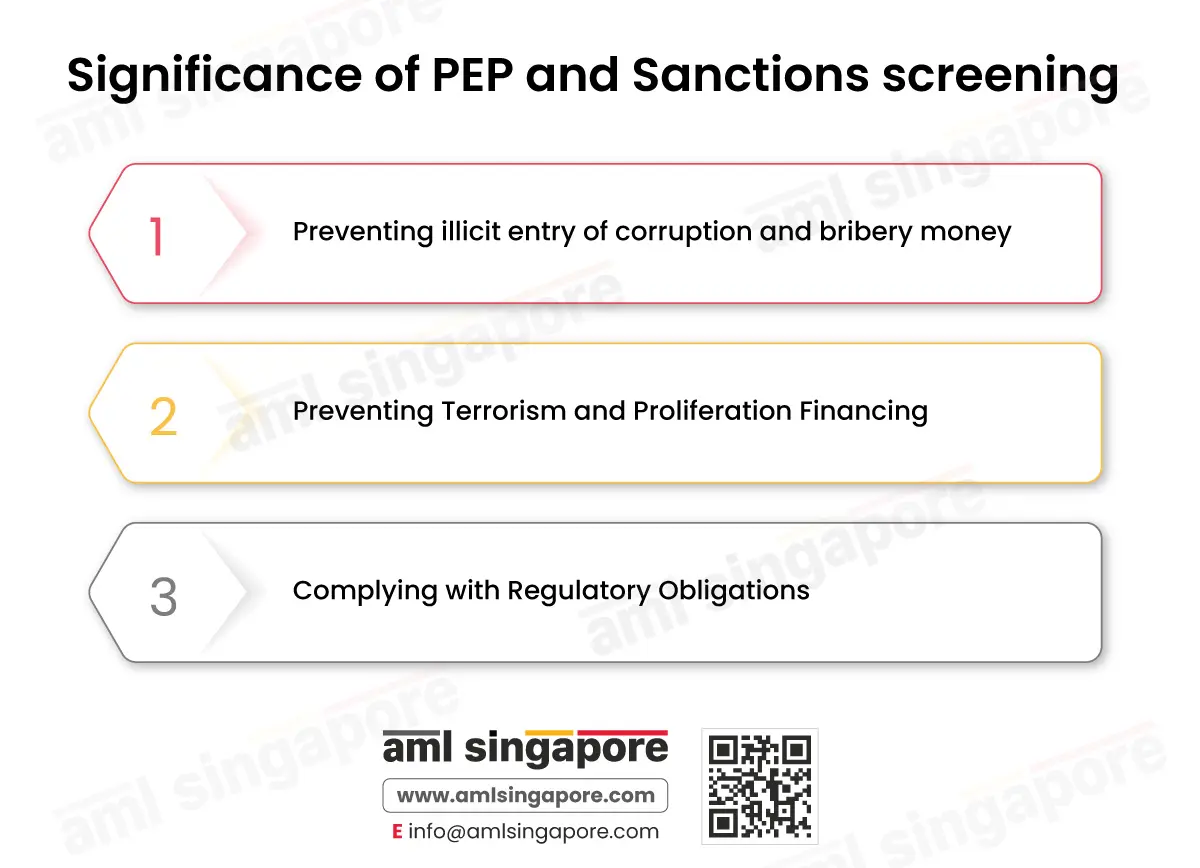

Significance of PEP and Sanctions screening

PEP and sanctions screening allow the regulated entities to identify and mitigate the ML/FT risks posed by high-risk individuals.

Preventing illicit entry of corruption and bribery money

The PEPs bear a high risk of being associated with corruption and bribery. Screening for PEPs and conducting enhanced due diligence helps the regulated entities monitor these individuals and manage the risk of being exploited by PEP to conduct money laundering using the regulated entity’s business. Further, PEP screening also helps entities detect suspicion of financial crime and timely report the same to the authorities.

Preventing Terrorism and Proliferation Financing

Sanctions screening results in uncovering the identity of the persons or organizations subject to economic sanctions owing to their known connections with terrorist organizations, proliferation of weapons of mass destruction, etc. Timely identification of sanctioned or designated persons helps the entity refrain such persons from accessing the financial system and executing terrorism or proliferation financing activities.

Complying with Regulatory Obligations

AML/CFT laws prevalent in Singapore mandates the regulated entities to implement adequate systems and controls to detect and prevent money laundering and terrorism financing. These measures prescribed by the law include mandatory identification of the PEP to deploy adequate risk management measures and sanctions screening to restrict business relationships with designated persons. Non-compliance with sanctions and PEP screening leads to substantial administrative fines and penalties on the entities, including reputational loss and loss of public trust and confidence.

Leveraging technology to strengthen the PEP and Sanctions Screening compliance

It is crucial to conduct the PEP and sanction screening process accurately. With disparate reliable data from different sources worldwide, identifying PEP and sanctions is the way forward for any organization that wants to be AML compliant and avoid non-compliance with the AML/CFT legislative landscape.

AML software helps monitor the customers continuously, syncing it with the latest updates in the sanction lists. Automating the screening process using emerging technologies like Artificial Intelligence (AI) or Machine Learning helps to screen customers and the Ultimate Beneficial Owners (UBOs) effectively. The accuracy of the screening outcome improves with automated tools, reducing false positives.

One-time screening is not sufficient as the person who is not a sanctioned or PEP today will not necessarily be so in the future. Thus, an ongoing automated screening is required to identify the change in the person’s status from non-PEP to PEP or non-designated to sanctioned person. With tools and technology, any change in the status of a person’s circumstances would be immediately alerted or flagged to the entity to take appropriate actions to prevent any case of money laundering.

With the help of AML software, businesses can automate the identification and screening process to detect the change in the risk posed by the customers and promptly deploy adequate risk mitigation measures, including reporting to the authorities.

With the help of technology, businesses can improve the process and make it more cost-efficient, reducing false alerts and warranting the intervention of the compliance team only in genuine potential hits. The AML software is nowadays embedded with advanced capabilities that assist in streamlining the AML compliance process—extracting information from different sources and screening customers intelligently helps businesses stay ahead of the curve and mitigate the AML compliance risks.

How can AML Singapore assist you in fostering your PEP and Sanctions screening requirement?

About the Author

Jyoti Maheshwari

CAMS, ACA

Jyoti has over 7 years of hands-on experience in regulatory compliance, policymaking, risk management, technology consultancy, and implementation. She holds vast experience with Anti-Money Laundering rules and regulations and helps companies deploy adequate mitigation measures and comply with legal requirements. Jyoti has been instrumental in optimizing business processes, documenting business requirements, preparing FRD, BRD, and SRS, and implementing IT solutions.