Red Flag Indicators for Precious Stones and Precious Metals Dealers

Red Flag Indicators for Precious Stones and Precious Metals Dealers

This article contains a detailed explanation of ML/FT/PF Red Flag Indicators for Precious Stones and Precious Metals Dealers, along with a list of red flags indicative of illegal activities that a regulated dealer should be aware of, which helps them to formulate and implement effective policies and procedures to prevent the occurrence of ML/FT and PF.

‘Red flag’ means drawing attention to or pinpointing a situation where attention is required. Simply, it indicates or draws attention to a problem, danger, or irregularity. In the domain of Anti Money Laundering/ Counter Financing of Terrorism and Proliferation Financing (AML/CFT/PF), red flags are indicators of potential ML/FT/PF instances.

AML/CFT/PF red flags are indicators or warning signs that a particular transaction, customer, or business carries a higher risk of involvement in money laundering, terror financing, or proliferation financing.

Regulated dealers, also referred to as Precious Stones and Precious Metals (PSPM) Dealers in Singapore falling under the authority of the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 (PSPM Act) benefit from having a structured method of identifying red flags.

The Precious Stones and Precious Metals Dealers (PSPMD) sector in Singapore comprises a diverse range of activities and scales of operations. The PSPMD sector has been subject to AML/CFT supervisory measures since April 2019. The Ministry of Law, Singapore, is responsible for supervising and regulating, which led to the enactment and enforcement of the PSPM Act, followed by the enforcement of Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Regulations 2019 (the regulations) and Guidelines to the regulations.

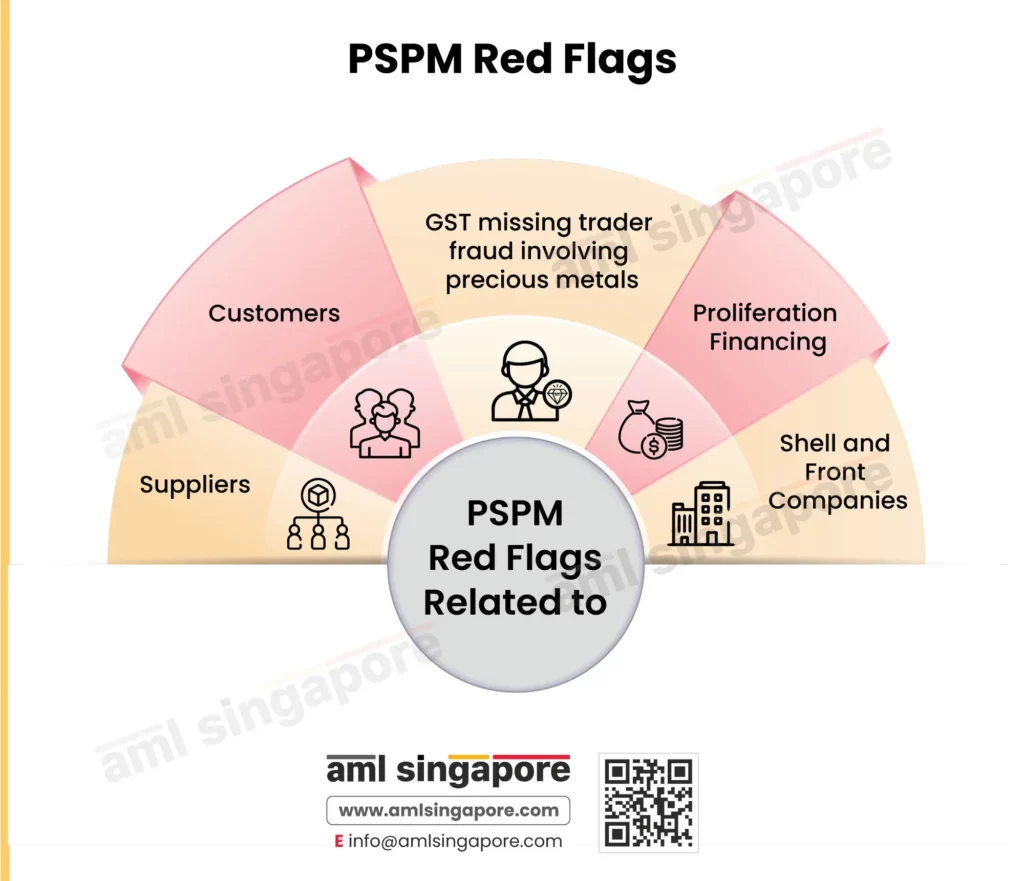

Latest Red flags according to the Guidelines for PSPM Sector for AML-CFT

The regulations mentioned above and guidelines are amended from time to time, keeping pace with evolving risks; for example, the previous guidelines contained red flags such as customers and suppliers, and the recently amended guidelines contain newly introduced Red Flag Indicators for Precious Stones and Precious Metals Dealers about the:

- Proliferation Financing

- Misuse of Shell and Front Companies

- GST Missing Trader Fraud (“MTF”) Involving Precious Metals.

The Meaning of Red Flag Indicators for Precious Stones and Precious Metals Dealers in AML/CFT

The Red Flag Indicators for Precious Stones and Precious Metals Dealers means activities that may indicate suspicious transactions or behaviours that a PSPMD may encounter in the routine business.

The Precious Stones and Precious Metals Dealers sector contains various value-chain activities, such as retail stores, wholesale/ distribution, manufacturing, second-hand goods dealing and online platforms. Thus, regulated dealers must be aware of red flag indicators that highlight the potential involvement of illicit proceeds of crime, TF, and PF activities.

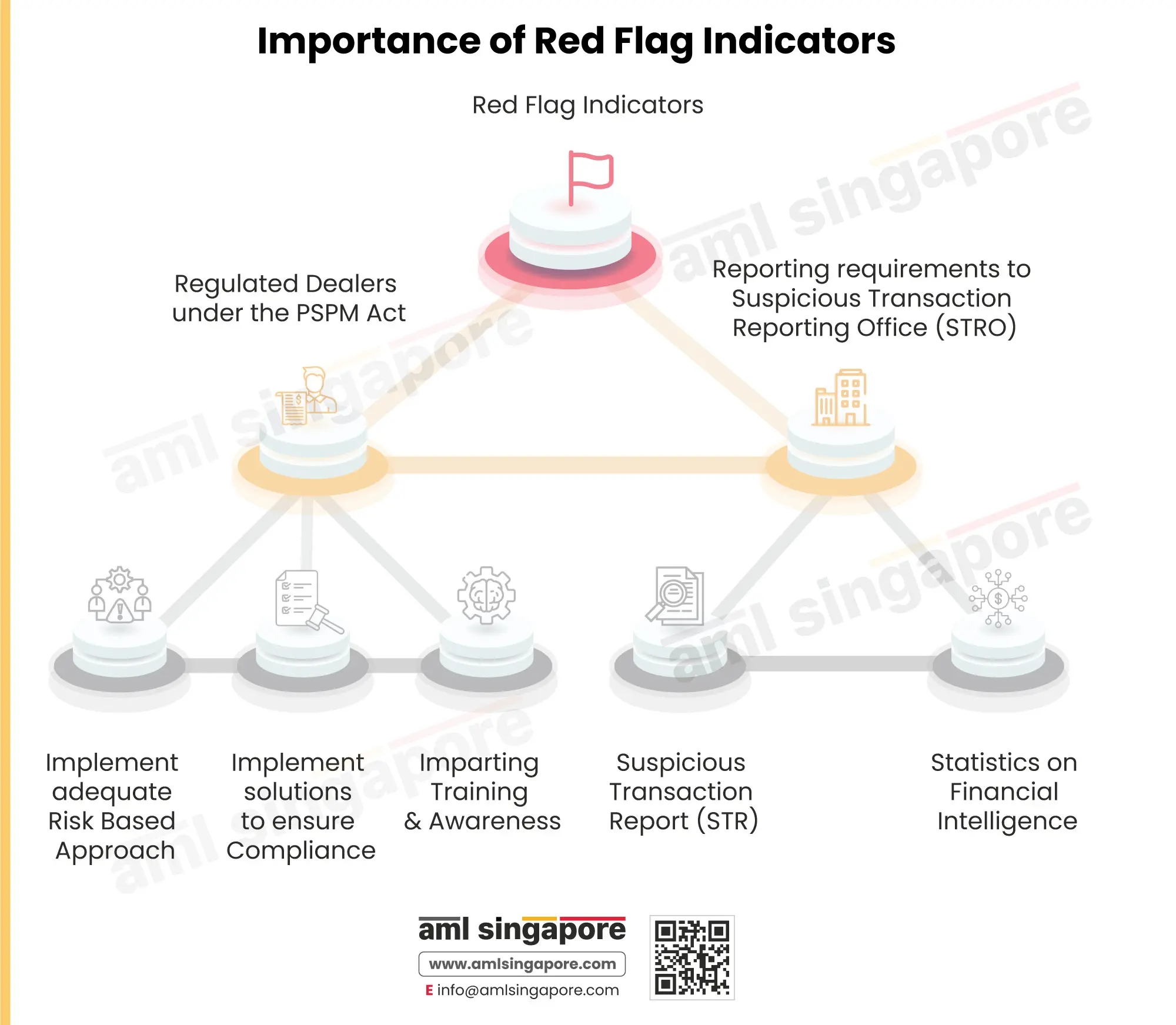

The Importance of Identifying Red Flag Indicators for Precious Stones and Precious Metals Dealers in AML/CFT

The importance of red flag indicators can broadly be devised in two categories by their utility:

1. Regulated Dealers under the PSPM Act

a. Implement an adequate Risk Based Approach

Red flag indicators help the regulated dealers in adopting a Risk based approach, as prescribed by law, and help them to identify, assess, and mitigate risks indicated by red flag indicators by implementing adequate and commensurate customer due diligence (CDD) and Enhanced Customer Due Diligence (EDD) measures.

b. Implement solutions to ensure Compliance.

c. Imparting Training & Awareness

The best way to prevent or avoid the regulated dealer from being used for ML/FT & PF is to ensure that their client-facing personnel, compliance and audit function, and senior management are well trained and well aware of the potential ML/FT and PF threats their company is prone to, thus helping them to identify and report such illicit activities to the Singapore, Financial Intelligence Unit (FIU) – Suspicious Transaction Reporting Office (STRO) promptly.

2. Reporting to Singapore's Suspicious Transaction Reporting Office (STRO)

STRO is Singapore’s Financial Intelligence Unit (FIU) and is responsible for receiving Suspicious Transaction Reports (STRs) and other financial information to take action and disseminate intelligence to relevant enforcement and regulatory agencies. STRO is a member of the Egmont Group and collaborates with FIUs of various other countries. Various compliance requirements for the PSPMD sector include the filing of reports given below, which can be identified through red-flag indicators in this article.

a. Suspicious Transaction Report (STR)

Red flag indicators aid the regulated dealer in meeting regulatory requirements by alerting them and making them sufficiently aware to identify transactions that necessitate STR filing, thus ensuring compliance with Section 45, Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992; and Section 8, Terrorism (Suppression of Financing) Act 2002 and “Possible Type of Crime” mentioned in the sample STR form, forming part of guidelines which states “if there is reason to suspect that the customer, a person on whose behalf the customer is acting or a Beneficial Owner of that person, maybe a terrorist, terrorist entity or designated person”.

b. Statistics on Financial Intelligence

Data gathered using reports filed by regulated dealers and other reporting entities helps the FIU compile statistical reports that aid various interrelated organisations in developing recommendations and guidelines to prevent ML/FT & PF.

Red Flag Indicators for Precious Stones and Precious Metals Dealers

Red Flags Indicators Related to Customers

Red Flag Indicators for PSPM regarding customers include a person with whom the regulated dealer enters into a transaction or may potentially transact. These red-flag indicators focus on customer-specific behaviour and transaction patterns, such as:

Transaction Patterns

Transaction patterns that are not consistent with the expected or known profile of the customer, such as transactions, are:

- Beyond the reasonable means of the customer based on their stated or known occupation or income

- Frequency of transactions is inconsistent with the usual frequency for such transactions

- Purpose of transactions not relevant to the known or expected operations of the business

- Substantial amounts of PSPM are involved

- With third parties without apparent legitimate business purpose

- Having no apparent business reason for PSPM and asset-backed tokens traded using bullion, investment, or asset-backed tokens

- Overpayment and refund of excess requests to a third party or in cash.

- Involving the use of stolen or fraudulent payment instruments

- Involving unusual or complex payment arrangements without apparent legitimate business purpose

Customer Behaviour

- Customers structuring amounts to avoid identifying or reporting thresholds

- Unusual and excessive inquiries about refund policies and requests for large refunds subsequently

- Extra interest in PSMD’s anti-money laundering and countering the financing of terrorism (“AML/CFT”) policies

- No sufficient explanation and documents for the source of funds for his transaction

- High level of secrecy concerning the transaction

- Willingness to buy/sell at unusually high or low prices

- Unusual hurry to complete the transaction

Red Flag Indicators Related to Suppliers

Transaction Patterns

- Inconsistent with the usual profile of a supplier

- Unusually structured and complex shipments which are over or under-insured

- Consignment size not consistent with the capacity of the supplier

- Wrong gold purity, weight, origin, and value classification on customs declaration forms

- Involving shell or front companies

- Transactions without legitimate purpose

- Transaction involving virtual assets whose ownership cannot be traced

Supplier Behaviour

- Inability to provide information for due diligence and record-keeping purposes

- Provides forged, fraudulent, or false identity documents

- Suppliers’ origins appear to be fictitious

- High level of secrecy concerning the transactionl

Red Flag Indicators Related to Proliferation Financing

Red Flag Indicators for PSPM regarding Proliferation Financing (PF) refers to providing financial backing to organizations that use the funds to manufacture, acquire, possess, develop, transport, or perform any illegal activity related to nuclear, chemical, or biological weapons. Red flags indicating critical vulnerabilities of PF to regulated dealers are customer-related and transaction-related red flags.

Customer-related red flags

- Vague and resistant when additional information is sought

- Activity mismatch or end-user information mismatch with the business profile

Transactions related to red flags

- Designated entities or individuals, subject to reporting requirements of the PSPM regulations.

- Higher-risk countries or jurisdictions

- Entities with known deficiencies in AML, CFT, countering PF controls, or the possibility of shell companies.

- Shipment container number changed or renamed.

- Shipment takes a circuitous route, or transaction takes a circuitous route.

- Shipment of goods inconsistent with regular geographic trade or consumer patterns.

- Inconsistencies in information such as trade documents, financial flows, destinations, ports, addresses, etc.

Red Flag Indicators Related to Shell and Front Companies

Money Launderers use shell or bogus companies that are operational only on paper but used to move funds without any actual business activity, and companies are created that act as front businesses wherein a blend of both the illicit proceeds and legitimate business operations are carried out, avoiding detection by authorities. Red Flag Indicators for PSPM regarding shell and front companies include

Pass through transactions.

Additional layers to mask proceeds from illicit activities, no real economic purpose.

Round Tipping Activities

Hidden Relationships

Hiding relationships between legal persons using nominees and shareholders with complex structures.

Use of similar name activities

Red Flag Indicators related to GST Missing Trader Fraud (MTF) Involving Precious Metals

Investment Precious Metals (“IPM”) gold bars exempt from the GST levy are melted/cut or defaced by syndicates for onward sale down the supply chain. Along the supply chain, a supplier fails to account for or pay the GST charged on his sales (the “Missing Trader”). In contrast, businesses along the supply chain continue to claim credit for input tax or refund of GST on their purchases. Missing Trader Fraud is a fraudulent means to cheat the revenue authorities, where the seller collects GST but does not submit it to the Inland Revenue Authority of Singapore (“IRAS”). The missing trader who must remit GST but fails to do so commits fraud and launders the proceeds. Red Flag Indicators for PSPM regarding GST Missing Trader Fraud (MTF) Involving Precious Metals include.

- High-value deals by the newly established supplier.

- Rapid turnaround of high-volume transactions.

- Back-to-back purchase-to-sale agreement.

- Out-of-the-norm credit terms.

- Too good be true deals recommended by unfamiliar introducers.

- Scrap gold bars in a condition not ordinarily traded in the market.

- Evasive supplier/trader.

- Material changes in the transaction with existing suppliers or customers.

Conclusion

- Red flag indicators pinpoint those suspicious activities that form a part of the placement and layering stages of the money laundering process, and awareness of the same helps to formulate and implement commensurate Risk Based Approach (RBA) policies and procedures, as recommended by the FATF.

- Red flag indicators help impart adequate training and awareness to the personnel and senior management of the regulated dealer, making them well aware and well-equipped to deal with and report potential ML/FT/PF events to the authorities.

- Red flag indicators point out what kind of AML/CFT compliance solutions, such as KYC, Customer Due Diligence (CDD), Enhanced Customer Due Diligence (ECDD) and Ongoing Monitoring tools, legal services, third-party services, and resources to protect against money laundering.

- Discussion of Red flags, such as the Use of Shell Companies, GST Missing Trader Fraud and Proliferation Financing, enable regulated dealers to conceptualise at what stages they may encounter ML/FT/PF activities and in which form, making them aware to take adequate mitigation measures.

FAQs on Red Flag Indicators for Regulated Dealers

Investment Precious Metals (“IPM”) gold bars exempt from the GST levy are melted/cut or defaced by syndicates for money laundering.

Precious metals and stones are very attractive to money launderers and terror financing organisations due to their high intrinsic value, easy mobility, and ability to be converted into cash. PSPM due to their ability to be stored, moved, converted, or used as a mode of transaction.

Diamonds are used for money laundering as they have high intrinsic value and relatively compact form. They tend to appreciate or increase in value over time, making them an alternative to actual money.

Additionally, the second-hand market for diamonds, where standardised valuation methodology for the re-sale of precious stones (due to the multiple variations in carat, cut, clarity and colour for precious stones) is challenging to implement, gives scope for money launderers to make use of loopholes in control measures to make their way for placement, layering and integration of illicit proceeds into the legitimate economic system, using diamonds and other PSPM.

Ready to take your AML compliance to the next level?

Empower your business with our record-keeping practices.

About the Author

Pathik Shah

FCA, CAMS, CISA, CS, DISA (ICAI), FAFP (ICAI)

Pathik is a Chartered Accountant with more than 26 years of experience in governance, risk, and compliance. He helps companies with end-to-end AML compliance services, from conducting Enterprise- Wide Risk Assessments to implementing the robust AML Compliance framework. He has played a pivotal role as a functional expert in developing and implementing RegTech solutions for streamlined compliance.