Source of Funds and Source of Wealth: Requirements and Differences

Source of Funds and Source of Wealth: Requirements and Differences

Requirements

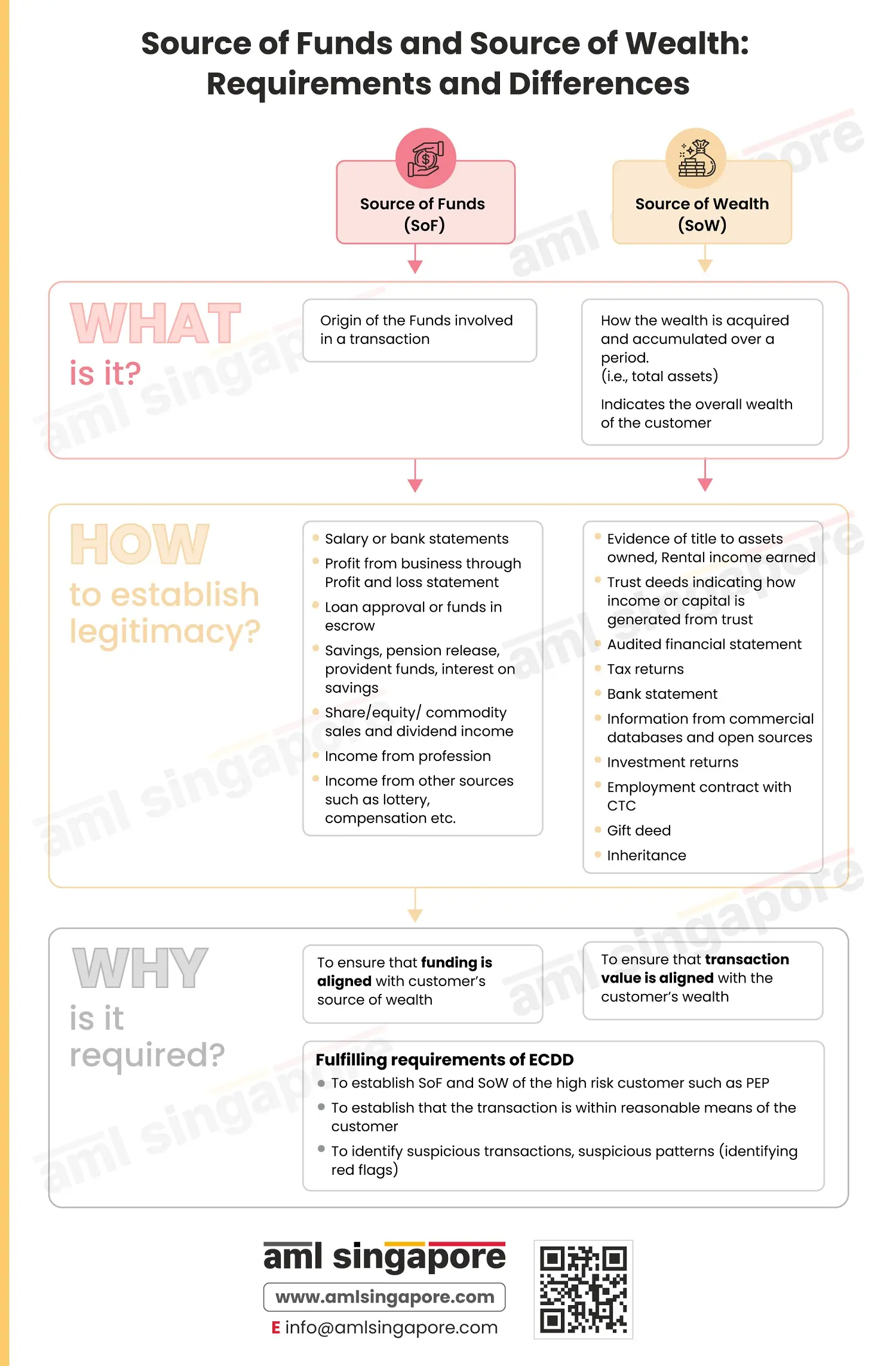

Regulated Dealers in Singapore are required to obtain the ‘Source of Funds’ (SoF) and ‘Source of Wealth’ (SoW) while carrying out Enhanced Customer Due Diligence (ECDD) for high-risk customers such as politically exposed persons (PEPs), persons associated with PEPs, customers belonging to high-risk countries.

The main point of difference between the source of funds and source of wealth is that the source of funds is verified in the context of a specific transaction; while verifying the source of wealth, a customer’s overall financial profile is checked. Thus, one can conclude that the source of funds is a narrower term when compared with the source of wealth.

However, the ultimate purpose of identifying the source of funds and source of wealth is to confirm that a transaction carried out by a customer is in line with their financial background.

For example, consider a customer performing a transaction of a large value that is generated by selling a property. However, upon verifying the customer’s source of wealth, it is concluded that the customer cannot possibly have a property that can generate a large sum of money. This shows a clear disconnect between the source of funds and the source of wealth, which can be indicative of money laundering activities.

Money Laundering (ML) usually involves disguising, diverting, or concealing the origin of money by purchasing and selling high-value products (such as gold/diamonds/ precious metals and stones) or services or wired through various account transfers.

The primary objective behind obtaining the source of funds or source of wealth documents is to establish legitimacy that the money used for transactions or shown as assets by the customer to prove their means to conduct transactions are not proceeds of crime.

Source of Funds

- Establish that the source of money involved for the particular transaction is within reasonable means of the customer.

- Establish that the goods purchased or services the customer avails are within reasonable means of the customer’s income.

Source of Wealth

- Establishes the overall wealth of the customer or beneficial owners

- Establishes the funds used are within reasonable means of the customer

- Establishes how such wealth was acquired

- Provides information on the reasons for intended or performed transactions.